DePIN Paradox: Rapid Growth, Slow Monetization

The problem isn't building the DePIN network, but using it

DIMO’s Exploration of DePIN

Despite its innovative concept, it has faced a range of practical challenges

-

The cold start problem: Automotive data must reach a certain scale and diversity to become attractive to commercial buyers. In the early stages of the network, the key lies in incentivizing enough vehicles to connect. DIMO has adopted a dual approach of token rewards and community engagement, such as launching developer incentive programs and organizing hackathons to expand application scenarios. However, unlike wireless networks that are ubiquitous, vehicles are inherently less accessible, which limits DIMO’s expansion speed. At present, its user base is primarily concentrated among a niche group of car owners in North America and parts of Europe, with network effects still in the early stages of formation.

-

Data quality and privacy: DIMO claims to uphold user data sovereignty, uploaded data is encrypted, and users can choose the scope of data sharing. While this approach helps build trust, it may also reduce the commercial value of the data. Overall, as an early DePIN project in the vehicle space, DIMO has demonstrated the feasibility of the “user-contributed hardware and data for rewards” model. However, to truly reshape the automotive data landscape, further progress is needed in lowering participation barriers, expanding the user base, and strengthening integration with the broader industry.

Comparison: Traditional Model vs. CyberCharge Mode

-

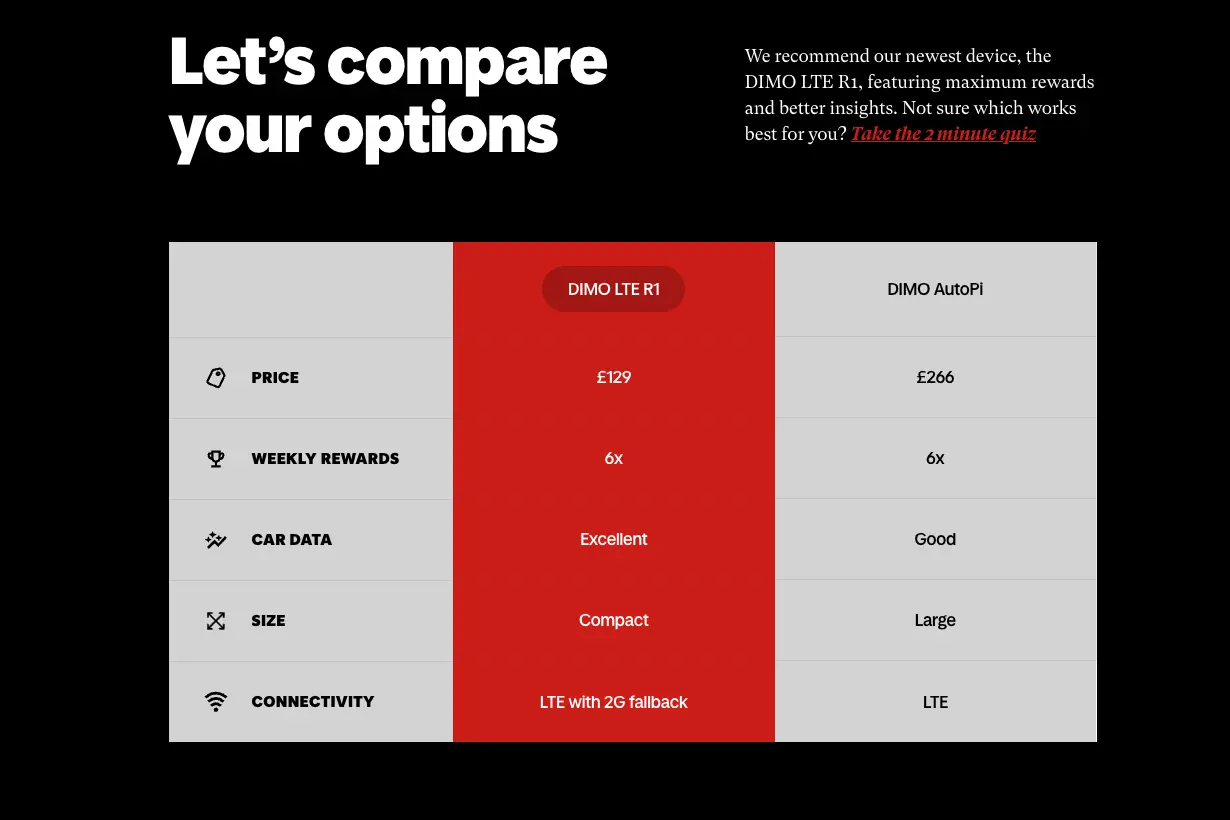

Hardware Deployment Cost: DIMO requires car owners to purchase an OBD terminal, with high end models priced around $266 and limited to compatible vehicles. In contrast, CyberCharge leverages a smart charger that resembles common electronic charging devices and is expected to cost significantly less. Moreover, since the device also serves a practical purpose—charging electronics—users experience less psychological resistance. Buying a CyberCharge device feels more like a consumer upgrade than a speculative mining investment.

-

User Participation Threshold: DIMO targets only car owners and requires a certain level of familiarity with vehicle digital systems. In contrast, CyberCharge significantly lowers the barrier to entry: anyone with a mobile phone or other electronic device can become a node, turning everyday charging behavior into a source of rewards. The process is simple—plug and play with no technical expertise required. This is a zero barrier. A high-frequency participation model has the potential to reach a much broader user base.

-

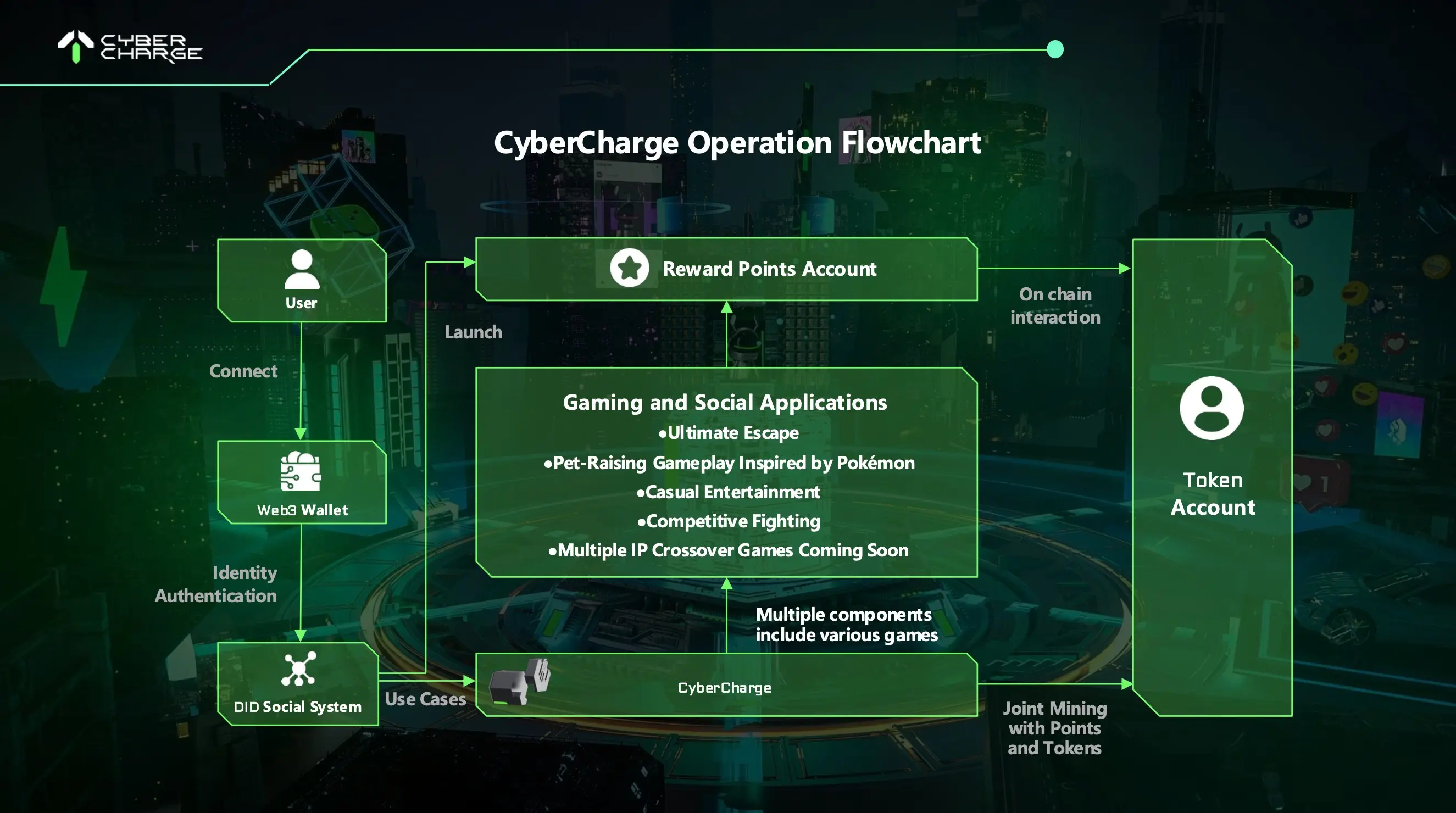

User Stickiness and Community Engagement: In most DePIN projects, participants tend to play a passive role after completing hardware deployment, with limited daily interaction. Community activity often hinges on fluctuations in token prices. In contrast, CyberCharge fosters a more engaged user base through interactive features such as virtual pets and mini games, encouraging users to stay within the ecosystem. Here, users are not just miners, they are also players and consumers. This layering of multiple identities fosters a stronger sense of belonging. A community built around high-frequency usage is more conducive to long-term retention and sustained value creation.

-

Security and Data Integrity: CyberCharge relies on its built-in CyberChip to ensure that every “proof of charge” recorded on-chain corresponds to actual energy consumption at the hardware level. This hardware backed trust mechanism enhances the credibility and reliability of the network’s data.

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

JuCoin 携手纳斯达克上市公司 Connexa 投资 5 亿美元打造 RWA 交易所 aiRWA

JuCoin 携手纳斯达克上市公司 Connexa 投资 5 亿美元打造 RWA 交易所 aiRWA今日,亚洲领先的加密货币交易所JuCoin与纳斯达克上市公司Connexa Sports Technologies Inc.(纳斯达克代码:YYAI,以下简称"Connexa")正式签署了一项5亿美元

-

AI16Z币是哪个国家的?2025项目背景、团队实力与监管动态

AI16Z币是哪个国家的?2025项目背景、团队实力与监管动态AI16Z币并非真实存在的加密货币,很可能是对知名风险投资机构Andreessen Horowitz(简称a16z)旗下加密货币投资部门a16z crypto的误解或混淆。以下为您解析a16z crypto的2025年项

-

从 mNAV 溢价到千亿美元构想:Michael Saylor 的比特币信用帝国之路

这场实验挑战了传统企业估值逻辑,其成败将影响数字资产行业的融资范式与监管走向。作者:Lesley,MetaEra在华尔街的金融创新史上,很少有人能像 Michael Saylor 这样,将个人信仰转化

-

泡泡玛特、女性和博彩

购物即博彩。撰文:John Wang编译:AididiaoJP,Foresight News由女性主导软性博彩的兴起一个女孩买了 3 个泡泡玛特盲盒,并拍摄了一段令人好奇的 TikTok 开箱视频。她

-

2025 AIOZ币前景分析:技术突破、市场潜力与资金动向

2025 AIOZ币前景分析:技术突破、市场潜力与资金动向AIOZ币作为区块链领域的新兴势力,其2025年发展前景需结合技术演进、市场接受度及资金流动综合判断。尽管具体数据有限,但通过行业趋势可推测其潜在机会与挑战。技术突破:区块链

-

新一轮发币潮来了,盘点 10 个值得关注的 Launchpad

平台核心竞争维度:公平性、门槛、项目资源、模式创新。作者:Biteye 核心贡献者 Viee编辑:Biteye 核心贡献者 Denise从Meme到AI Agent,Launchpad与传统股权挂钩的

-

AIOZ币是哪个板块的?2025项目简介、技术特点与投资机会

AIOZ币是哪个板块的?2025项目简介、技术特点与投资机会AIOZ币属于区块链的去中心化存储赛道。就像顺丰快递让包裹存储更安全便捷,AIOZ币瞄准的是用区块链技术重构数据存储。这个项目把全球闲置的硬盘空间聚集成为共享云盘,用户存数

-

WLFI 上线倒计时:孙宇晨等早期投资者狂赚十余倍,Aave 分成提案陷争议

WLFI代币总供应量为1000亿枚,已完成25%的公募,孙宇晨是最大个人投资者,DWF Labs等机构参与做市。作者:Nancy,PANews又一天王级项目即将亮相,由特朗普家族支持的加密项目 Wor

- 成交量排行

- 币种热搜榜

泰达币

泰达币 以太坊

以太坊 比特币

比特币 USD Coin

USD Coin Solana

Solana 瑞波币

瑞波币 OK币

OK币 First Digital USD

First Digital USD 币安币

币安币 ChainLink

ChainLink 狗狗币

狗狗币 Wormhole

Wormhole 莱特币

莱特币 艾达币

艾达币 波场

波场 CFX

CFX HT

HT GT

GT OKT

OKT EOS

EOS MX

MX FIL

FIL ETC

ETC