Multi-Asset Margin Explained: A Comparison Across 5 Major Exchanges

Writer: yoyo

The Evolution of Margin Trading: Understanding Multi-Asset Margin

In the early stages of the industry, exchanges primarily relied on single-margin accounts, where each contract uses a single asset (such as BTC or USDT) as margin. This approach often resulted in fragmented capital and limited flexibility. Later, the introduction of the multi-asset margin margin model allowed users to employ multiple stablecoins within the same account. However, this system still requires frequent reallocation of funds across different contracts, creating inefficiencies.

In recent years, leading platforms have introduced multi-asset margin mechanisms, which consolidate multiple assets into a unified margin pool. This represents the most advanced stage in the evolution of margin systems. The primary objective of the multi-asset margin mechanism is to address critical shortcomings of traditional models: capital fragmentation, low liquidity efficiency, and elevated liquidation risks. Under single-margin models, assets remain siloed, making it difficult to respond quickly to market volatility. For instance, when a position nears its liquidation threshold, additional assets in the account cannot be allocated as margin to maintain it, which increases the likelihood of liquidation.

By combining supported tokens such as BTC, ETH, and USDT into a shared margin pool, multi-asset margin allows profits and losses from different Futures positions to be automatically offset. In practice, this means gains from one contract can directly cover losses in another, enhancing both stability and efficiency.

This design substantially improves capital utilization, offering professional traders greater flexibility to manage multi-strategy, multi-asset portfolios. Against this backdrop, major exchanges continue to explore differentiated implementations and parameter settings, aiming to balance robust risk controls with an optimized user experience.

Battle of the Giants: Multi-Asset Margin Across 5 Leading Platforms

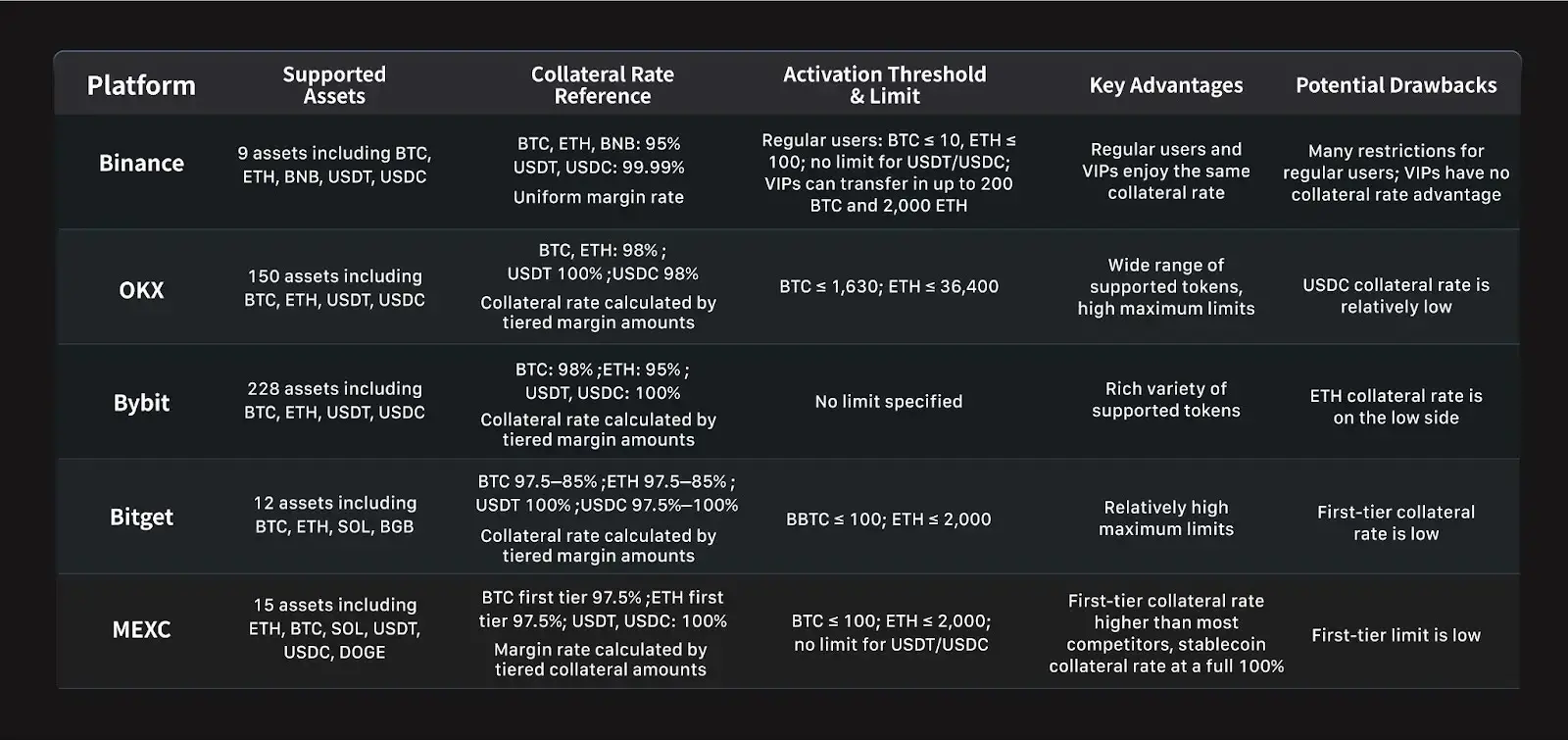

As of today, all five leading exchanges, Binance, OKX, Bybit, Bitget, and MEXC, have rolled out multi-asset margin mechanisms. While the concept has become an industry standard, platforms still differ significantly in terms of supported assets, collateral ratios, and entry thresholds.

Across the five platforms, several points of consensus have emerged:

-

Shared margin pools with multiple assets, with core stablecoins generally credited at high collateral rates.

-

Tiered collateral rates, withBTC andETH typically ranging between 85%–98%.

-

Layered limits designed to mitigate risk exposure through stepwise thresholds.

Yet, key differences remain in supported assets, entry thresholds, and conversion strategies:

-

Binance and OKX represent institutional stability, offering higher limits that favor large-scale capital and professional traders.

-

Bybit and Bitget lean toward the broad coverage approach, supporting a wide variety of tokens but applying steeper discounts in collateral rates and limits.

-

MEXC, on the other hand, adopts a mainstream-focused & low-barrier approach: supporting BTC, ETH, USDT, and USDC, with a first-tier collateral rate of 97.5% and stablecoins credited at 100%.

This strategy signals that MEXC isn't competing head-on in terms of breadth of coverage or high institutional limits. Instead, it focuses on the mid-tier active trader segment:

-

Low entry thresholds: Attractive for users without high VIP tiers or million-dollar balances.

-

High first-tier collateral ratios: With BTC and ETH at 97.5%, the structure satisfies the majority of trading needs while still applying step-down logic at higher tiers.

-

Mainstream asset support: Ideal for high-frequency traders who rely on BTC, ETH, and stablecoins as their primary collateral.

In a landscape where the largest platforms are competing to capture breadth and institutional capital, MEXC has carved out a clear position, prioritizing flexibility, accessibility, and efficiency for active mid-tier traders.

Why Choose Multi-Asset Margin

In Perpetual Futures trading, capital efficiency, risk management, and operational simplicity are critical to success. MEXC's Multi-Asset margin mode enables 15 different assets, including BTC, ETH, SOL, USDT, and DOGE, to be consolidated into a single shared margin pool for opening USDT- or USDC-M Futures. This unified asset mechanism offers three core advantages: enhanced capital efficiency, reduced liquidation risk, and a seamless trading experience.

1. Maximized Capital Utilization

Under the traditional single-margin model, traders often encounter the isolated margin problem: large amounts of idle assets in wallets cannot directly be used for Futures trading and must first be converted into USDT. This not only increases transaction costs but can also cause traders to miss fast-moving market opportunities.

For example, suppose a user holds 1,000 SOL (valued at 200 USDT each), 1,000,000 DOGE (valued at 0.2 USDT each), and 10,000 USDT. In the traditional model, only the 10,000 USDT can be used as margin. In Multi-Asset margin mode, SOL and DOGE can be used as collateral, all integrated into the shared pool. So the collateral is calculated as follows:

SOL Margin = 300 × 200 × 95% 300 × 200 × 90% 400 × 200 × 85%

-

= 57,000 54,000 68,000 = 179,000 USDT

DOGE Margin = 200,000 × 0.2 × 95% 200,000 × 0.2 × 90% 600,000 × 0.2 × 85%

-

= 38,000 36,000 102,000 = 176,000 USDT

-

USDT Margin = 10,000 USDT

-

Total Margin = 179,000 176,000 10,000 = 365,000 USDT

Compared with the traditional model, the same asset base now provides 36.5 times greater position-opening capacity.

2. Lower Liquidation Risk

Multi-Asset margin significantly reduces the risk of liquidation on individual positions by offsetting profits and losses across multiple positions. When one position shows an unrealized loss, the unrealized gains from other positions are automatically allocated to the shared pool, providing a buffer and enhancing risk resilience.

For example, a trader holds 1 BTC (current price 100,000 USDT) as initial margin. After applying the collateral rate, the account margin is 100,000 × 97.5% = 97,500 USDT. The trader then opens a short position of 0.975 BTC on BTCUSDT with 10x leverage, giving the position a notional value of 975,000 USDT. Under the Multi-Asset Margin mode, the BTC asset in the account and the position share the same margin pool, with PNL dynamically offset.

Suppose BTC rises by 9.5% to 109,500 USDT:

-

Unrealized PNL on the short position: (100,000 - 109,500) × 0.975 × 10 = -92,625 USDT, which is almost equal to the initial margin of 97,500 USDT, bringing the position close to liquidation. However, the rise in BTC price also increases the value of the account margin.

-

Collateral value: 109,500 × 97.5% = 106,762.50 USDT, an increase of 9,262.50 USDT compared to the initial 97,500 USDT, which provides a buffer.

-

Under the Multi-Asset Margin mode, although the Futures position incurs a loss, the appreciation of the margin asset partially offsets the unrealized PNL, preventing immediate liquidation and thereby reducing the risk of liquidation to some extent.

3. Simplified Accounts, Fewer Transfers

In the traditional model, managing multiple positions means constant transfers and conversions—costing time, a 0.05% fee, and additional slippage. With Multi-Asset margin, all assets are combined into a single pool, allowing you to open positions instantly without conversion. This all-in-one margin approach gives traders faster, more efficient access to market opportunities.

Which Traders Can Benefit Most

1. Investors Balancing Long-Term Holdings with Futures Trading

Users holding multiple mainstream digital assets often face the problem of idle funds sitting unused, or are forced to convert assets frequently, disrupting their portfolio structure. Multi-Asset Margin allows those idle assets to be used directly as collateral, preserving the original portfolio while also providing the natural diversification benefits of a multi-asset mix.

2. Traders Capturing Cross-Market or Cross-Asset Spreads

Arbitrage requires speed to seize short-lived price discrepancies. Under isolated margin, funds are fragmented, management is complicated, and liquidation risk is higher. Multi-Asset margin solves this by offering shared liquidity and automatic profit/loss offsets across positions, reducing liquidation risk and improving arbitrage efficiency.

Ex: ETHUSDT = 4,500, BTCUSDT = 100,000, implied ETH/BTC = 0.045 vs. spot 0.045225 ( 0.5% deviation). With 20x leverage:

-

Short 200 ETHUSDT (total: 900,000 USDT; initial margin: 45,000 USDT)

-

Long 9 BTCUSDT (total: 900,000 USDT; initial margin: 45,000 USDT)

-

If the spread converges: ETH drops 1% (profit = 9,000 USDT), BTC rises 0.5% (profit = 4,500 USDT). Total profit = 13,500 USDT (excluding fees, funding, and slippage).

3. High-Frequency Traders Entering Daily Positions

High-frequency traders need speed and low costs. Frequent transfers and conversions slow execution and eat into profits with fees. With Multi-Asset margin, positions can be opened directly using existing assets, minimizing time and costs for capital allocation. This reduces operational friction and lets traders focus on strategy and market analysis.

What to Keep in Mind When Using Multi-Asset Margin

While Multi-Asset Margin improves efficiency, it also comes with risks that must be carefully managed:

1. Broad Market Downturns: If multiple collateral assets fall at the same time, the pool's value can shrink rapidly. Collateral buffers may not be enough to absorb the shock, potentially triggering chain liquidations.

2. Cross-Margin Only: Currently, all positions share the same pool. If the pool is depleted, all positions may be liquidated simultaneously—exposing the entire balance, unlike isolated margin where risk is limited to a single position.

3. Complexity for Beginners: Multi-asset management and dynamic margin adjustments can be difficult for inexperienced traders. Misjudging the market or misusing leverage may result in significant losses, especially if one cannot adapt to fast-changing margin requirements.

The Future of Multi-Asset Margin: Winning Over the Professional User Base

As an integral component of crypto trading infrastructure, multi-asset margin has rapidly evolved into a standard feature of derivatives platforms. Today, the competition is no longer defined simply by whether multi-asset margin is supported, but by who can deliver the optimal balance of user experience, strategy adaptability, security, and account structure. There is no universal answer to this challenge. What is clear, however, is that as traders grow more sophisticated and demand greater capital efficiency, the quality of a platform's multi-asset margin design will play a decisive role in determining whether these users choose to remain.

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

BscScan是什么公链?支持哪些主流钱包?实用指南

BscScan是什么公链?支持哪些主流钱包?实用指南BscScan是Binance Smart Chain(BSC)生态的核心区块链浏览器,可实时查看链上交易、区块等数据,本身并非公链。BSC公链支持huli钱包、Trust Wallet等主流钱包,这些钱包为用户提供资产存储、交易签名等功能,是进入BSC生态的重要工具。

-

从华尔街到香港:顶级机构转向链上,为何首选 Canton Network?

Canton Network 具备可定制隐私、全网互操作性以及无限水平扩展等优势,旨在更好的连接传统金融与加密资本市场。撰文:深潮 TechFlow引言「金融的未来在链上」已成为共识,并随着美国 SE

-

AI 代理支付时代:谷歌 AP2 协议点燃战火,十大加密项目抢滩新大陆

AP2 宣告了一个由 AI 驱动、连接传统金融与加密世界的全新商业时代正在开启。撰文:Yuliya,PANews9 月 16 日,一个看似普通的日子,却可能成为 AI 发展史上的一个关键拐点。谷歌在这

-

如何质押CHZ币?2025最新质押方法实用技巧详解

如何质押CHZ币?2025最新质押方法实用技巧详解本文详细介绍CHZ币质押的准备工作、核心步骤(含钱包配置、平台连接、参数设置)、风险规避及收益监控方法,助用户掌握质押实操并获取收益。

-

如何在Bybit交易所买币?实用操作教程与避坑指南

如何在Bybit交易所买币?实用操作教程与避坑指南本文详细介绍Bybit交易所买币的完整操作流程,涵盖注册、实名认证、绑定支付方式等准备工作,拆解从登录到完成交易的核心步骤,并提供风险规避方法与常见问题解答,助力新手安全高效掌握加密货币购买技巧。

-

如何开BTC账户?2025实用入门教程:钱包配置与KYC指南

如何开BTC账户?2025实用入门教程:钱包配置与KYC指南本文详解2025年BTC账户标准化开设流程,涵盖开户前软硬件准备、基础知识储备与合规平台选择,系统拆解账户初始化、钱包架构搭建及资金通道配置核心步骤,并提供密钥管理与风险防控实用指南,为新手提供可操作实践路径。

-

如何挖Bome币?2025最新Bome币挖矿教程实用指南

如何挖Bome币?2025最新Bome币挖矿教程实用指南本文为2025年Bome币挖矿提供最新教程,涵盖硬件配置(GPU矿机、存储设备等)、软件环境搭建、矿池接入、核心挖矿步骤及收益管理、风险规避要点,助新手从零开始掌握完整挖矿流程。

-

有哪些交易所可买cat币?catcoin上线平台汇总实用指南

有哪些交易所可买cat币?catcoin上线平台汇总实用指南文章汇总了Cat币(Catcoin)上线的五家主流加密货币交易所,介绍各平台合规性、流动性及新手友好功能(如零手续费、语音导航等),并提醒市场波动风险,建议分批建仓,是购买catcoin的实用参考。

- 成交量排行

- 币种热搜榜

UXLINK

UXLINK 泰达币

泰达币 以太坊

以太坊 比特币

比特币 Solana

Solana USD Coin

USD Coin 狗狗币

狗狗币 瑞波币

瑞波币 First Digital USD

First Digital USD 币安币

币安币 莱特币

莱特币 ChainLink

ChainLink 艾达币

艾达币 Sui

Sui Worldcoin

Worldcoin BAKE

BAKE YGG

YGG OKB

OKB FIL

FIL LINA

LINA CFX

CFX EOS

EOS HT

HT AVAX

AVAX SHIB

SHIB