【Bitmidas Weekend Special】Bitcoin Trend Analytics 12th March 2022

BTC/USD, using Investing data flow for the analysis.

Recap

Yesterday, we mentioned that the price would be confined within the range between 42421.6~37017.70, centering 39846.10 and we would see a wrestle at the center.

From 15:00–22:00, the price was trying to break up 39846.10 but failed. The lowest price came back to 38236.4, supported by 38495. The highest price then touched 40177 and fall back under the pressure at 40519.5.

The opening price today is 38730.2 (08:00 UTC+8)

Market Analysis

As BTC is still running within the congestion and maintaining a similar momentum and level range, I suggest you keep focusing on the points suggested previously. The weekend is a good time to refresh, so I’ll do a general market analysis instead.

Looking back from Feb 28th to Mar 1st, when Russia invaded Ukraine and sanctions were put on crypto-assets for Russian, we saw a large inflow of buying orders of 4k BTC based on reliable news and stats. BTC price was quickly pulled up to 41500~42000 from 38000 and reached 44900~45000 on Mar 1st.

Many people believed that BTC finally came to be a safe-haven asset like gold and was back on a bullish track. But the reality gave them a hard blow — BTC price plunged quickly to the key support area of 37017.70 on Mar 7th.

On Mar 9th, a piece of news indicating a positive attitude of the US Treasury on crypto-assets lit up the market. A good bounce-back seduced many to open long positions. The reality again dampens the bullish spirits. Lessons learned from this is following the rules of statistics.

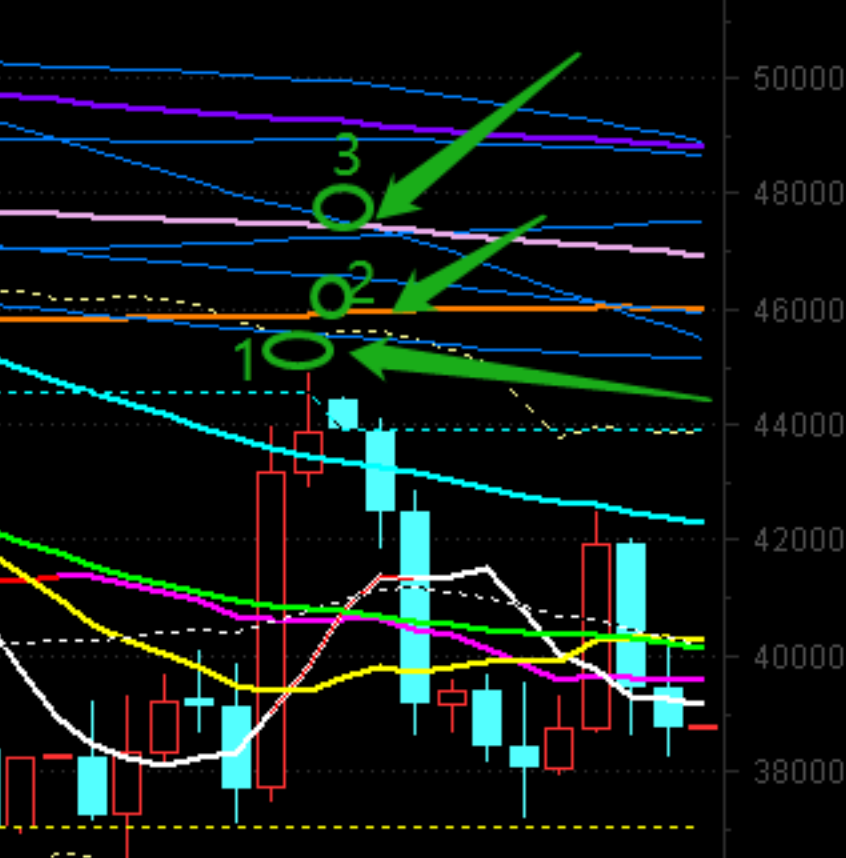

On 1d frame, I have 3 downtrend lines suppressing the price each day from Feb 28th to Mar 1st based on my algorithm.

It’s clear that a resistance based on my calculation prevented the price from rising during the days on Mar 9th and 10th. On that day, a friend asked me how Biden’s executive order would be interpreted in crypto, my reply was that it’s positive to the crypto market as a whole, but price should still run within the congestion in the short term. The fact of the price drop on Mar 10th speaks itself as we depicted it in statistics.

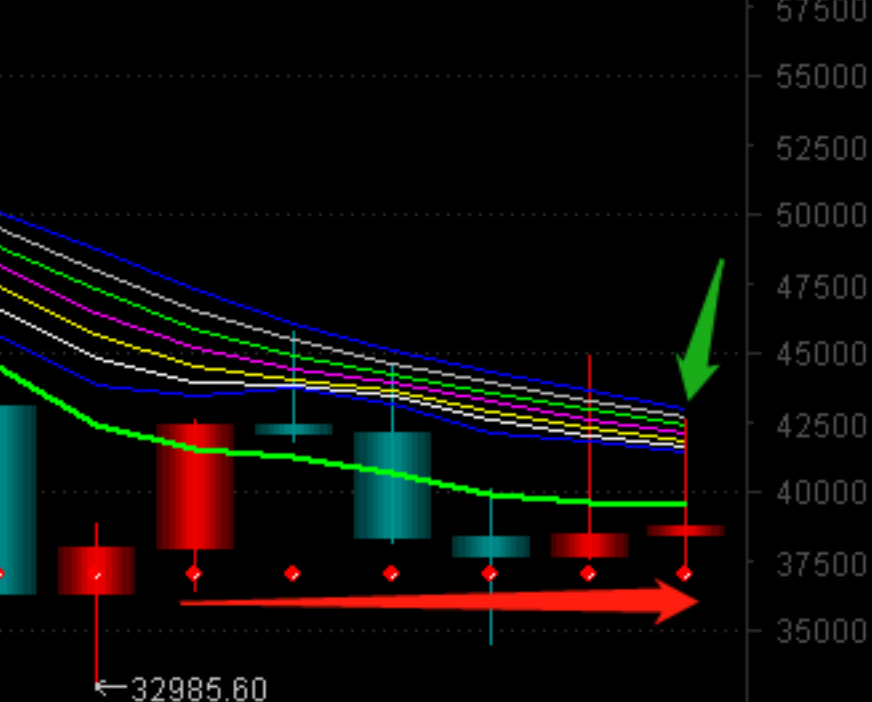

On 1w frame, you can see the red line resistance is there preventing the price from rising above it. Take a special look at the bounce on Mar 9th, that line, based on my calculation, takes a stronghold of resistance.

All the resistances and supports are shown as lines on chats. What lies behind them is the battle between longs and shorts of speculators, and they change their positions according to the market trend. One piece of news is hard to shift the market in a short period of time.

Therefore, before making any breakthroughs, the market will still be running within the congestion.

On a 1 month frame, we are clearly in between a key resistance (indicated by 1) and support (indicated by 2) range. It’s hard to tell which side will quickly win out. So the price will keep bouncing back and forth within a large congestion area.

This type of movement will be shown as a hike or a dump on a 1d frame, often caused by a piece of news.

I shared my opinion from the first day of 2022 when there was a similar market trend, but I didn’t write it down and publish it on Twitter. Now I decide to make an extra effort to share my experience with more friends in crypto. Hope you like it, see you next week.

Follow us on https://twitter.com/BitMidas to get instant daily updates!

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

OKB 暴涨 500% 背后,是情绪狂欢还是价值重估?

OKB 暴涨 500% 背后,是情绪狂欢还是价值重估?作者:1912212.eth,Foresight News 8 月 22 日,OKX 继续刷新历史新高,价值一度触及 258.6 美元,24 小时涨幅超 30%,实现日线图 3 连涨,从底部 50 美

-

俄罗斯暂停加密挖矿禁令,税收下降是背后主因是什么?

俄罗斯暂停加密挖矿禁令,税收下降是背后主因是什么?俄罗斯的挖矿产业,过去几年可真是“西伯利亚的野马”——撒丫子狂奔!为啥?电便宜啊! 尤其是伊尔库茨克这种地方,电价低到矿工们半夜笑醒,直接被称为“俄罗斯矿都”。但问题来了:矿

-

多链开发者占比突破1/3,EVM兼容链如何简化跨链开发?

多链开发者占比突破1/3,EVM兼容链如何简化跨链开发?就像手机充电器终于统一了Type-C接口,EVM兼容链正在用”万能开发模板”吃掉多链生态的蛋糕。数据显示,现在每3个区块链开发者就有1个在玩多链开发,而EVM系项目占到了74%的跨链

-

亚洲加密开发者数量为何超越北美?开发者报告揭示关键原因

亚洲加密开发者数量为何超越北美?开发者报告揭示关键原因最近一份区块链开发者报告显示,亚洲加密开发者数量已经超过北美40%,这个现象背后隐藏着几个你可能想不到的有趣原因。早餐店老板都能理解的技术生态在亚洲,区块链技术就像楼下

-

Giants Protocol 在 2025 年巴厘岛 Coinfest 展示 RWA 与 AI 愿景

Giants Protocol 在 2025 年巴厘岛 Coinfest 展示 RWA 与 AI 愿景印度尼西亚,巴厘岛 —— Coinfest Bali 2025 汇聚了区块链领域最具创新力的先锋,Giants Protocol 登台展示其通过 AI 驱动的基础设施,重塑现实世界资产(RWA)与去中

-

再质押协议TVL破300亿:EigenLayer如何改变以太坊生态?

再质押协议TVL破300亿:EigenLayer如何改变以太坊生态?最近区块链圈最火的词就是”再质押”了!EigenLayer这个再质押协议就像个超级吸金池,锁仓金额(TVL)突破300亿美元大关。今天咱们就用买菜大妈都能听懂的大白话,拆解这个改变以太

-

从 0 到爆发,Sui 生态 Momentum 将撬动下一轮流动性风暴?

随着 Sui TVL 持续增长和机构采用加速,Momentum X 将成为 Crypto 领域的关键基础设施。撰文:1912212.eth,Foresight News想象一下,2028 年的一个早晨

-

BasePaint案例:链上协作艺术如何实现90%收益自动分配?

BasePaint案例:链上协作艺术如何实现90%收益自动分配?BasePaint就像个线上涂鸦墙,但它有个酷毙了的设定——所有卖画收益的90%都自动分给参与创作的艺术家们!今天咱们就用”小区公告板”的逻辑,拆解这个区块链艺术平台的神奇玩法。

- 成交量排行

- 币种热搜榜

泰达币

泰达币 以太坊

以太坊 比特币

比特币 USD Coin

USD Coin Solana

Solana 瑞波币

瑞波币 OK币

OK币 First Digital USD

First Digital USD 币安币

币安币 ChainLink

ChainLink 狗狗币

狗狗币 Wormhole

Wormhole 莱特币

莱特币 艾达币

艾达币 波场

波场 CFX

CFX HT

HT GT

GT OKT

OKT EOS

EOS MX

MX FIL

FIL ETC

ETC