【Bitmidas】Bitcoin Trend Analytics 15th March 2022

BTC/USD, using Investing data flow for the analysis.

Recap:

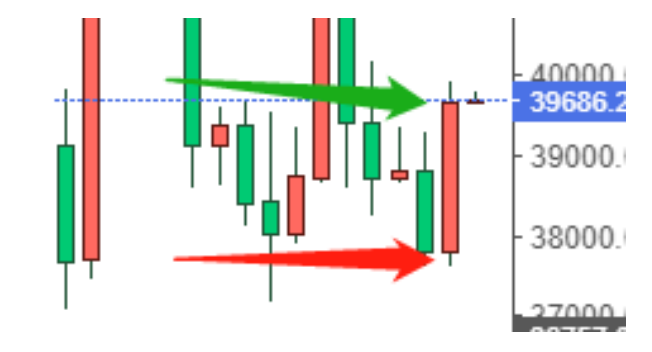

Yesterday BTC tested the critical area at 37140~37017.70 multiple times, and the price was moving between 39615.5~37017.70 for some time.

We could see the price was kept in the range. Today the opening price is 39673 at 8:00 UTC+8.

Trend Analysis:

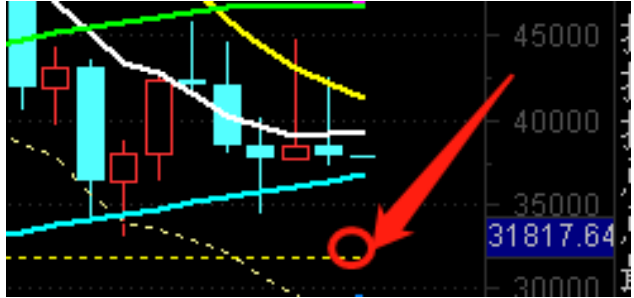

Now BTC is in a congestion range between 43912.8 ~ 37017.70, centering 39962.22.

As 37017.70 serves as strong support, the price bounces back to the central. Consequently, we’ll see the price frequently moving back and forth around the center before tomorrow. Tomorrow’s FOMC meeting will be held. Any Fed’s adjustment to the interest rate will have a certain impact on BTC. The present interest rate is 0–0.25%. Inflation has climbed to 8% recently, and there’s no sign of declining, then raising the interest rate is inevitable. However, we don’t know how much increase in the interest rate is in line with the market expectation. This ratio will impact the financial market and even more on BTC.

Now BTC is still running in the congestion. Whether it rise or fall, it will eventually come near the center because the market is waiting for a clear signal from the Fed. Therefore, BTC is driven to a breakout at any time today.

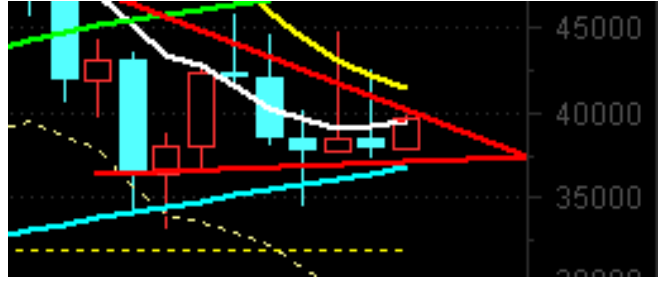

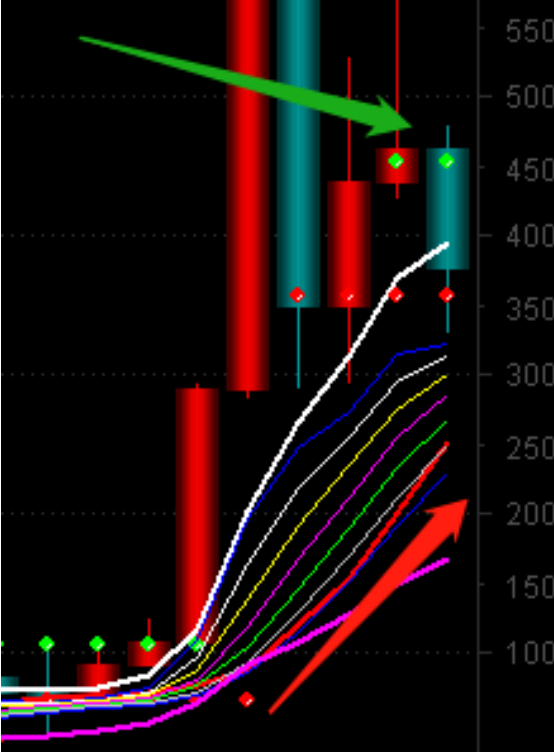

The red triangle in the chart indicates that the price is compressed almost to its limit. From the result of the FOMC meeting on Mar 16th, the market will choose a direction.

Raising interest rates usually put pressure on BTC and drives the price downward. But there’s no absolute in the financial market. If the actual rise in interest rate is less than that of market expectation, then the CM will pull up and take in the profit from the short orders.

In the face of the possibilities of either direction, I recommend you, drawing from my own experience, to watch closely on the center. As the breakout is near, price kept above the center is likely to see an upward change and vice versa.

Taking the center as a reference will help you predict direction quickly. However, if you’re not good at trading during the change, you should avoid risks and wait for the change.

No matter which direction it takes, the rising interest rate will put real pressure on BTC, as it leads to a fund outflow. Nevertheless, BTC is still in a bullish trend. The Price Change will force BTC to run in another congestion range and show itself towards a more apparent direction.

In my calculation today, the power of Price Change could kick the price up to 43912.8 ~ 47017 on the top, or down to 35351.31~35009; 31785.40 at the bottom. If it breaks 31785.40, there would be dumping further to an area at 28501.9.

Well, I have given out all the tips and the calculation on the strength. Be on your guard to manage your assets. Again, keep watching for the center.

There are 3 level ranges to focus on:

1. The central at 39962.22, a key reference to decide on the direction. The price will move around it within the range. When the market choose a direction, take it as a critical indicator.

2. A key supporting area between 37140~37017.70. This is a crucial resistance today. As long as the price remains above it, BTC will recover in the range. If it’s broken, however, we cannot see a pullback to touch 37017.70 again within 3–5 days, and the congestion range automatically is adjusted to 37208~28501.9.

3. The upper range at 43912.8 gradually diverted from 45000. This is strong resistance in terms of positions as well as market sentiment. Only by breaking up 45000 could we see a true recovery of market confidence.

Although BTC decreases in the short term, it remains on a bullish track in the long term. Currently, BTC is in correction among a long-term bullish trend, resulting in the price moving back and forth between key supports and resistances.

Supports:38901~38802; 38019; 37140~37017.70; 36475.50; 35351.31~35009; 34132.52; 32927.70; 31785.40; 30000; 29220.63; 28501.9; 27315.14~27170.43; 25352.16; 23779.54 (pointless to see further down atm)

Resistances:39962.22(wrestle at the central); 40556.30; 41326; 41808~42200; 42075.51; 42562.19; 43821.59~43912.8; 44995~45084.05; 45968.85; 46810.53~47409.95; 48719.63~49084.21; 50843.93 (pointless to see further above atm)

Follow us on https://twitter.com/BitMidas to get instant daily updates!

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

2025年新开发者首选Solana还是Base?高性能链对比分析

2025年新开发者首选Solana还是Base?高性能链对比分析Solana更适合需要高并发的DApp开发,Base则胜在与以太坊生态无缝衔接。选择哪条链,关键看你的项目类型——就像选跑车还是越野车,得看你要跑什么路!1. 性能对决:TPS就像地铁发车间

-

BRCA法案保护非托管服务,核心意义是什么?

BRCA法案保护非托管服务,核心意义是什么?说到比特币和区块链,想必你会想到那些酷炫的技术术语,什么”去中心化”啊,”智能合约”啊,最近还有个”非托管服务”也火得不行。但你知道吗?就在我们沉迷于这些概念的时候,大洋彼

-

华兴资本与 YZi Labs 达成深度战略合作,共同推动金融科技创新与 RWA 生态建设

华兴资本与 YZi Labs 达成深度战略合作,共同推动金融科技创新与 RWA 生态建设华兴资本控股有限公司(“华兴资本”“华兴”,股票代码:1911.HK)发布公告,宣布一项重大战略举措:通过与知名投资机构YZi Labs Management Ltd(“YZi Labs”)签署战略合

-

Crypto Fight Night闪耀,区块链周新亮点是什么?

Crypto Fight Night闪耀,区块链周新亮点是什么?先说说这个活动的背景。2025年菲律宾区块链周期间,一个叫Crypto Fight Night Onchain(链上加密拳击之夜)的活动横空出世,直接和全球顶尖的区块链会议挂钩。你可能要问:”拳击和

-

XRP符合MiCA资格,合规优势与市场影响

XRP符合MiCA资格,合规优势与市场影响最近欧洲加密市场有个大新闻——XRP 正式被欧盟”招安”了!不对不对,准确来说是被纳入了MiCA(加密资产市场法规)框架,归为”实用代币“类别。可能有些朋友会问:”MiCA是啥?实用代币

-

AAVE面临调整,技术指标释放哪些信号?

AAVE面临调整,技术指标释放哪些信号?AAVE近期走势引发市场关注,从技术面来看,三个关键信号正在释放调整警报。就像行车时的仪表盘突然亮起黄灯,这些指标正在提醒用户需要系好”安全带”。信号1:成交量萎缩如同泄气

-

收益型稳定币会是下一个万亿赛道?深度解析潜在价值

收益型稳定币会是下一个万亿赛道?深度解析潜在价值稳定币市场正在从单纯的交易工具向多元化金融产品进化,其中收益型稳定币可能成为2025年最具潜力的发展方向之一。数据显示,当前收益型稳定币仅占市场10%份额,但在看跌市场环境

-

Matrixport 市场观察:BTC、ETH 或将维持震荡,结构化工具成关键对冲与增益手段

Matrixport 市场观察:BTC、ETH 或将维持震荡,结构化工具成关键对冲与增益手段在 2025 年三季度,数字资产市场正处于宏观环境与资金流动双重因素的博弈之中。通胀与利率政策的波动、资金的大规模涌入与短期获利了结,以及衍生品市场的避险信号,共同塑造了 BTC 与 ETH 的价格轨

- 成交量排行

- 币种热搜榜

泰达币

泰达币 以太坊

以太坊 比特币

比特币 USD Coin

USD Coin Solana

Solana 瑞波币

瑞波币 OK币

OK币 First Digital USD

First Digital USD 币安币

币安币 ChainLink

ChainLink 狗狗币

狗狗币 Wormhole

Wormhole 莱特币

莱特币 艾达币

艾达币 波场

波场 CFX

CFX HT

HT GT

GT OKT

OKT EOS

EOS MX

MX FIL

FIL ETC

ETC