【Bitmidas】Important! Bitcoin Trend Analytics 16th March 2022

BTC/USD, using Investing data flow for the analysis (Deciding on the direction)

Recap:

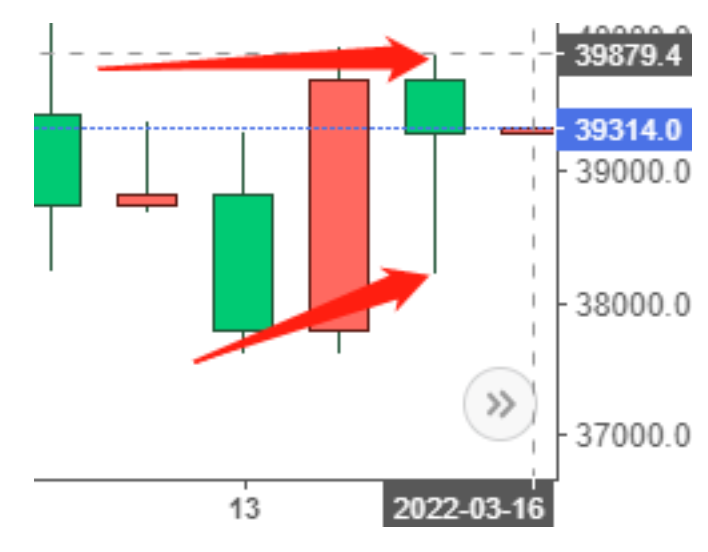

Yesterday, BTC came upon a period of choosing directions. We should pay attention to Fed’s decision. We saw the price oscillated frequently around the central yesterday.

The highest price came to 39854.7, suppressed by the calculated center at 39962.22. The lowest price was 38220.9, supported by 38019, which is also within my calculation. The frequent oscillation has driven BTC close to the center.

Today the opening price is 39282.5 at 8:00 UTC+8.

Trend Analysis:

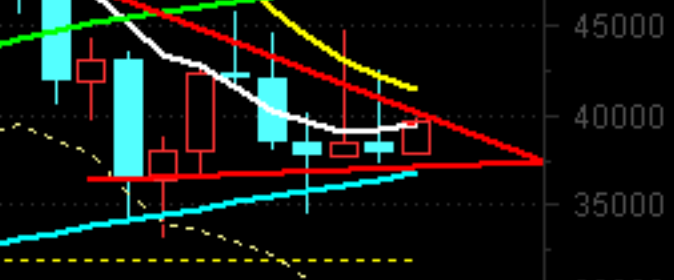

Now BTC is in a congestion range between 43912.8 ~ 37017.70, centering 39876.76.

Today the center is dragged a little bit lower than that of yesterday, so its force is slightly weakened but it still functions as a fortress for both sides. The breakout will happen soon and be swayed by 2 factors.

1. Price is above the center, upwards; Price being under the center, downwards.

2. Fed’s decision on raising interest rates lower than market expectation, upwards; Fed’s interest rates higher than the expectation, downwards.

Now the price is under the center, so the latter gives pressure on price. Since it’s diverted downward, its force weakens. Both sides are still trying to take control over the center, and either side could win anytime. When the shift comes, we should refer to the Fed’s decision to decide if the price would continue to stay above or beneath.

Fed’s meeting starts on Mar.16th, with the interest rates now being 0–0.25%, the market expatiation is 0.5%. The result will come out on Mar.17th, when we can make a fair judgment.

If the interest rates <0.5%, lower than expectation, fund outflow weakens, so the price is likely to break up. If the interest rate >0.5%, higher than expectation, fund outflow strengthens, so the price is likely to fall.

There is also a possible situation when interest rates =0.5%. That’s when we should make judgments with reference to the center. In this case, if the price remains above the center, it’s likely to go up and vice versa.

As I mentioned yesterday, the red triangle in the chart indicates that the price is compressed almost to its limit. Price will go bumpy within these two days. The direction should be made clear on Mar.17th. Nevertheless, choosing a direction is only a temporary breakout. BTC will mainly be affected by the actual interest rates.

With inflation at 8%, a rising interest rate is inevitable. Every time the adjustment to the interest rates will lead to funding outflows in crypto, bringing pressure to the price, apparently on BTC.

Read from a 1-month time frame, BTC is in a bullish trend. The breakout will force BTC to run in another congestion range and show itself towards a more apparent direction.

Now BTC is still running in the congestion. Every rebound is restricted within my calculated area, and every downfall is underpinned by 37140~37017.70, which prevented the price from entering lower-range congestion.

As price always returns to the calculated center, waiting for a clear sign of a breakout, and follows the pattern I predicted in the short term. I believe you might have figured out who I am and my trading preference. My old friends who are familiar with my trading should know this turning point is profitable but also comes with high risks. If you’re not good at trading at this point of time, you’d better wait after the change.

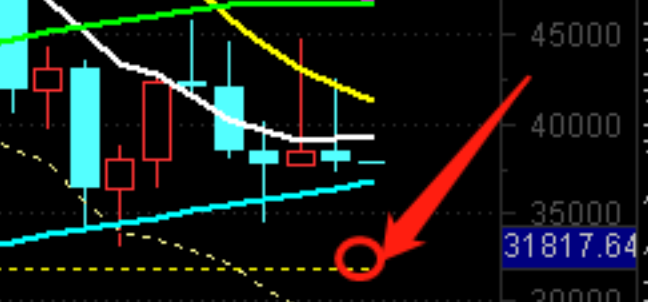

Same as yesterday’s prediction, the power of breakout could kick the price up to 43912.8 ~ 47017 on the top, or down to 35351.31~35009; 31785.40 at the bottom. If it breaks 31785.40, there would be dumping further to an area at 28501.9.

Well, I have given out all the tips and the calculation on the strength. It’s up to your own risk preference to manage your assets. If you trade, again, keep watching for the center and refer to Fed’s decision on interest rates. If not, wait and avoid risks.

There are 3 level ranges to focus on:

1. The central at 39962.22, a key reference to decide on the direction. The price will move around it within the range. When price changes, take it as a critical indicator.

- 2. A key supporting area between 37140~37017.70. This is a crucial resistance at the lower range. As long as the price remains above it, BTC will recover in the range. If it’s broken, however, we cannot see a pullback to touch 37017.70 again within 3–5 days, and the congestion range automatically is adjusted to 37208~28501.9.

3. The upper range at 43912.8 gradually diverted from 45000. This is strong resistance in terms of positions as well as market sentiment. Only by breaking up 45000 could we see a true recovery of market confidence.

Although BTC decreases in the short term, it remains on a bullish track in the long term. Currently, BTC is in correction among a long-term bullish trend, resulting in the price moving back and forth between key supports and resistances.

Supports:

38908.58~38853.05; 38019; 37140~37017.70; 36475.50; 35351.31~35009; 34132.52; 32927.70; 31785.40; 30000; 29220.63; 28222.56; 27315.14~27170.43; 25352.16; 23779.54; 22324.10 (pointless to see further down atm)

Resistances:

39876.76 (wrestle at the central); 40556.30; 41326; 41982~42200; 42562.19; 43821.59~43912.8; 44995~45084.05; 45968.85~46029.04; 46810.53~47409.95; 48719.63~49084.21; 50843.93 (pointless to see further above atm)

Follow us on https://twitter.com/BitMidas to get instant daily updates!

*Not Financial Advice*

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

币安(Binance)的创始人是谁?

币安(Binance)的创始人是谁?币某安的创始人是CZ,这位1977年出生于江苏的华裔加拿大人,从麦当劳打工仔做起,最终成为全球最大加密货币交易所的掌舵人。他的故事堪称币圈最励志的创业传奇,用8年时间将币某安

-

以太坊创始人叫什么?

以太坊创始人叫什么?以太坊的创始人是90后俄罗斯裔加拿大程序员维塔利克·布特林(Vitalik Buterin),他在2013年19岁时提出了以太坊的概念,如今已成为区块链领域最具影响力的人物之一。天才少年的区

-

Stellar (XLM) 和瑞波币 (XRP) 有什么区别?

Stellar (XLM) 和瑞波币 (XRP) 有什么区别?Stellar(XLM)和瑞波币(XRP)这对区块链界的”双胞胎”实在太像了——都是跨境支付赛道的老将,都主打快速转账和低成本。但就像豆浆和豆奶的区别,内在特质截然不同。咱们今天就掰开

-

Meme币(如DOGE, SHIB, PEPE)的风险有多大?

Meme币(如DOGE, SHIB, PEPE)的风险有多大?Meme币就像游乐园的过山车——刺激但容易摔伤。DOGE、SHIB、PEPE这些网红币虽然可能让你一夜暴富,但更可能让你瞬间血本无归。它们本质上都是”互联网表情包+赌场筹码”的结

-

以太坊基金会注册在哪个国家?

以太坊基金会注册在哪个国家?以太坊基金会(Ethereum Foundation)的注册地是瑞士楚格州,这个被称为”加密谷”的小城聚集了全球50%以上的区块链项目。选择这里可不是拍脑袋决定的——中立的国际地位、友好的

-

币安(Binance)总部最初设在哪里?

币安(Binance)总部最初设在哪里?币某安总部最初竟然设在一台笔记本电脑上!这个全球最大加密货币交易所的创业故事,比多数人想象的更接地气。从上海民宅起步的数字游民2017年创立的币某安,最初根本不存在实体办

-

Cosmos (ATOM) 生态怎么样?

Cosmos (ATOM) 生态怎么样?如果说比特币是区块链世界的第一代独行侠,以太坊是第二代万能工具箱,那么Cosmos绝对是第三代”区块链互联网”的领跑者。想象一下,每个区块链就像一间独立的房子,Cosmos就是给这

-

Chainlink (LINK) 是做什么的?

Chainlink (LINK) 是做什么的?Chainlink就像区块链世界的”电话接线员”,专门负责把现实世界的信息准确无误地传给智能合约。想象一下:智能合约是位足不出户的”宅男”,而Chainlink就是他的外卖小哥和快递员

- 成交量排行

- 币种热搜榜

泰达币

泰达币 以太坊

以太坊 比特币

比特币 USD Coin

USD Coin Solana

Solana 瑞波币

瑞波币 OK币

OK币 First Digital USD

First Digital USD 币安币

币安币 ChainLink

ChainLink 狗狗币

狗狗币 Wormhole

Wormhole 莱特币

莱特币 艾达币

艾达币 波场

波场 CFX

CFX HT

HT GT

GT OKT

OKT EOS

EOS MX

MX FIL

FIL ETC

ETC