【Bitmidas】Bitcoin Trend Analytics 17th March 2022

BTC/USD, using Investing data flow for the analysis.

Time of Analysis 08:50 UTC+8

Time of Translation & Publication 11:15 UTC+8

Recap:

In the analysis published yesterday, we predicted that volatility of the price would be accompanied by Fed’s decision. Bulls and bears vied to take control over the center. I suggested you make judgments first by interest rates (>5% or <5%), then by the position of price when the interest rates equal 5%.

We saw fierce competition between bulls and bears and the momentum shifted multiple times yesterday. Fed announced a rise of 25–50bp on interest rates to 5% early in the morning on Mar.17th. This has been psychologically accepted by the market when the price is above the center. So the price went up, which is in line with my judgment.

Today the opening price is 41118.7 at 8:00 UTC+8.

Trend Analysis:

Although BTC went through violent fluctuations yesterday and temporarily went up, the strength has yet to be released so the price is still within the range I calculated.

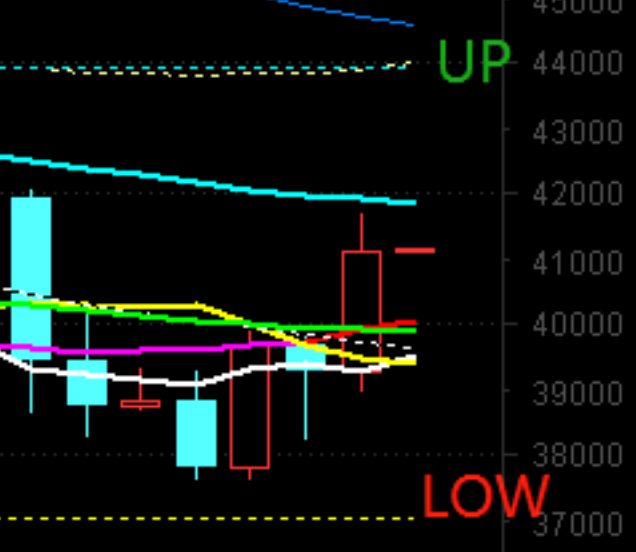

Now BTC is in a congestion range between 43912.8 ~ 37017.70, centering 40005.15.

This is because Fed’s decision had been priced in with 5% interest rates. The news came without negative influence on the price, neither was it a good one. Raising interest rates, after all, means fund outflow in general. This weakens the outbreak to some extent.

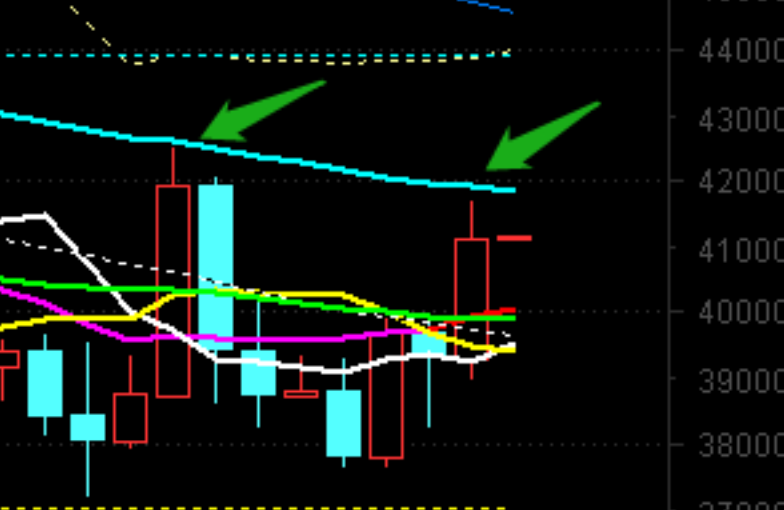

The triangle is broken up, but it’s not stable and we will see more consolidations and breakthroughs.

The broke-up yesterday didn’t go beyond the upper line of my calculation. This trend line has suppressed the price since Mar.9th and it’s diverted from 42600 to 41947.58 today.

BTC stands above the center with a great effort. So the center serves less resistance as days before, rather more support within the range.

Today the price will firstly move between 41947.58~40005.15. Only when it breaks 41947.58 would it unleash the power to challenge 43912.8.

We should pay attention to the test to the center. If the center is tested multiple times, it will fall back into a wrestle at the center.

FOMC has passed, yet unfinished. I assume there would be a 5–7 times rise in interest rates. The next decision will be made on May 5th, 2022, when another battle will begin.

What matters most to the interest rates is inflation. If inflation keeps going up, the US is likely to add more bps to the interest rates, which could be bad news to crypto, and vice versa.

There are 3 level ranges to focus on:

1. The central at 40005.15. The price will move around it within the range. When the shift comes, take it as a critical indicator.

2. A key supporting area between 37140~37017.70. This is a crucial resistance at the lower range. As long as the price remains above it, BTC will recover in the range. If it’s broken, however, we cannot see a pullback to touch 37017.70 again within 3–5 days, and the congestion range automatically is adjusted to 37208~28501.9.

3. The upper range at 43912.8, gradually diverted from 45000. This is strong resistance in terms of positions as well as market sentiment. Only by breaking it up could we see a true recovery of market confidence.

Currently, BTC is in correction among a long-term bullish trend, resulting in the price moving back and forth between key supports and resistances.

Supports:

40005.15; 39522~39376.62; 38908.58~38853.05; 38019; 37140~37017.70; 36475.50; 35351.31~35009; 34132.52; 32927.70; 31785.40; 30000; 29220.63; 28222.56; 27315.14~27170.43; 25352.16; 23779.54; 22324.10 (pointless to see further down atm)

Resistances:

41947.58.~42200; 42620.72; 43821.59~43912.8; 44038.20; 44751~45194.10; 46085.95; 46695.37; 47295.18; 48719.63~49084.21; 50843.93 (pointless to see further above atm)

Follow us on https://twitter.com/BitMidas to get instant daily updates!

*Not Financial Advice*

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

GemW 开启链上 Alpha 交易新时代 :降低门槛、激励创作者、构建协作型 DeFi 生态

GemW 开启链上 Alpha 交易新时代 :降低门槛、激励创作者、构建协作型 DeFi 生态近日,由全球领先加密资产交易平台 CoinW 币赢团队推出的,聚焦链上早期资产与热门 Meme 板块的智能交易平台 GemW 正式上线。该平台聚焦「易用性」和「可持续创作者激励」,致力于降低链上交易门

-

从领跑到跟跑:为何 SOL 难敌 ETH 的攻势?

SOL 落后 ETH 的真因:财库策略、ETF 与叙事差距。撰文:kkk8 月 13 日,ETH 强势突破 4,700 美元,创下四年来的新高,而同一时期的 SOL 却显得力不从心,始终徘徊在 200

-

从领跑到跟跑:为何SOL难敌ETH的攻势

从领跑到跟跑:为何SOL难敌ETH的攻势8 月 13 日,ETH 强势突破 4,700 美元,创下四年来的新高,而同一时期的 SOL 却显得力不从心,始终徘徊在 200 美元附近。2024 年,Pump.fun 带动了整条 Solana 链

-

稳定币在美国将取代信用卡成为主流支付方式

稳定币将复刻信用卡的发展路径,然后取而代之。撰文:Daniel Barabander编译:AididiaoJP,Foresight News目前关于稳定币在美国消费者支付领域的讨论非常热烈。但大多数人

-

何一:从乡野山村到加密权力之巅,诠释「加密女王」的破局之道

「既然说了好,就不说疼。」撰文:Jeff John Roberts,财富杂志编译:Saoirse,Foresight News20 世纪 80 年代,何一还是个小姑娘时,要步行到井边打水,家里有时还得

-

叫板Pump.fun,Bags的“创作者优先”玩法能否颠覆Meme币发行 | CryptoSeed

叫板Pump.fun,Bags的“创作者优先”玩法能否颠覆Meme币发行 | CryptoSeed作者:Zz2025年八月,据 Defillama 的数据,当Pump.fun仅一周收入便超858万美元,以 67.9% 的市场份额位列Solana平台第一。然而,据Solidus Labs 《The

-

链上 Pre-IPO 时代来临,各加密公司如何布局?

链上 Pre-IPO 时代来临,各加密公司如何布局?今年 6 月,互联网券商巨头 Robinhood 面向欧洲用户推出了一项新服务,提供 OpenAI、SpaceX 等顶级未上市独角兽公司的「股票代币」交易机会。Robinhood 甚至向符合条件的新用

-

三万部手机组成的越南机器人农场:如何从真实用户手中偷走加密空投?

三万部手机组成的越南机器人农场:如何从真实用户手中偷走加密空投?作者 :Felix Ng 编译 :吴说区块链 Aki Chen 在距离胡志明市仅 40 分钟车程的一座带冷藏系统的 “铁皮棚” 里,Mirai Labs 首席执行官 Corey Wilton 首次真正

- 成交量排行

- 币种热搜榜

Caldera

Caldera Ethena

Ethena 泰达币

泰达币 比特币

比特币 以太坊

以太坊 USD Coin

USD Coin Solana

Solana 瑞波币

瑞波币 First Digital USD

First Digital USD 狗狗币

狗狗币 币安币

币安币 波场

波场 Sui

Sui 莱特币

莱特币 Wormhole

Wormhole CFX

CFX EOS

EOS CRV

CRV FIL

FIL ACH

ACH CAKE

CAKE XCH

XCH UNI

UNI HT

HT