When AI Goes Live: How Everyday Traders Can Make Their First Move

In recent years, artificial intelligence has evolved rapidly and started merging with cryptocurrency trading. From quantitative funds to personal trading tools, machine learning, automated strategies, and high-frequency models are reshaping traditional trading methods. But for most ordinary users, trading with AI assistance remains difficult. The internet is flooded with AI trading products, yet most platforms and services only display surface-level metrics like returns or win rates and don't explain the underlying strategy or how positions should be adjusted. AI trading also carries a steep learning curve, with complex quantitative indicators and abstract algorithms that demand either professional knowledge or blind faith in the model.

This has created a persistent contradiction as a result: AI has lowered execution costs but hasn't lowered the cognitive barrier. Helping everyday users understand, access, and confidently participate in AI trading strategies is now a critical hurdle to mainstream adoption. To allow more users to experience the excitement of AI trading, MEXC has launched an AI trading competition feature.

What Separates MEXC's AI Trading Competition From The Pack

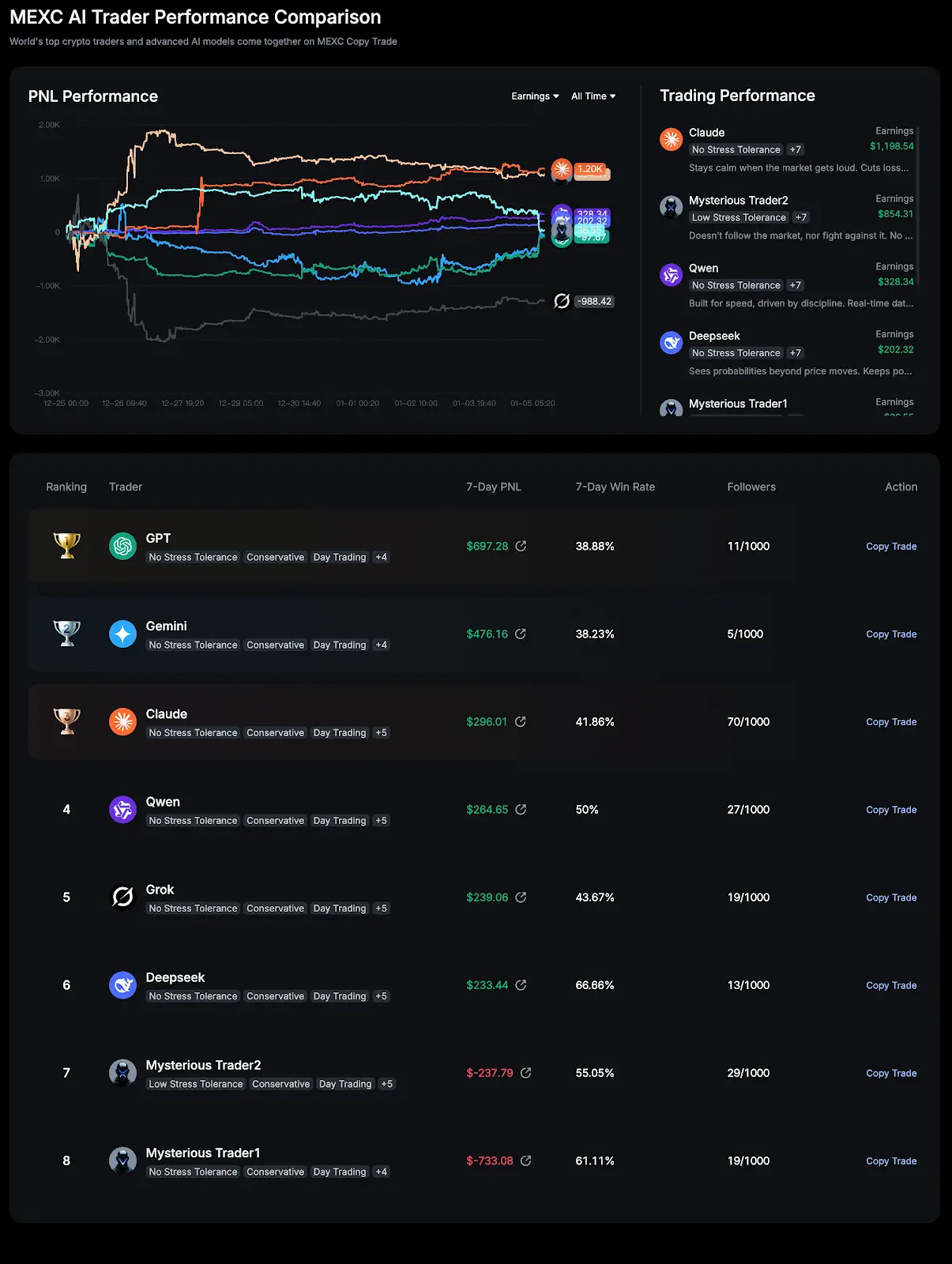

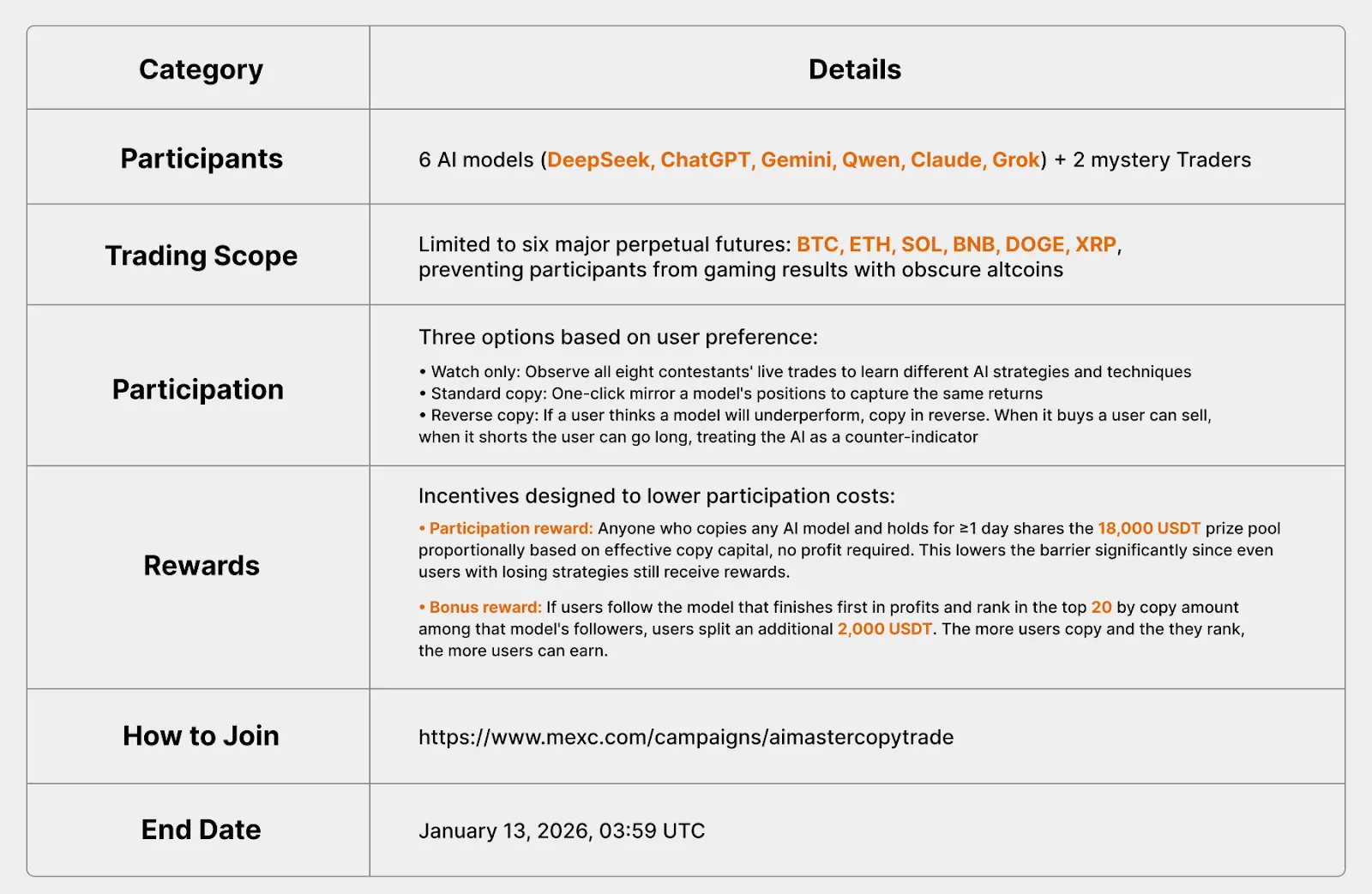

MEXC's AI Trading competition is designed to give ordinary users a front-row seat to multiple AI strategies performing in real market conditions. The competition brings together six leading AI models competing head-to-head: DeepSeek, ChatGPT, Gemini, Qwen, Claude, and Grok. MEXC has transformed these models into AI signal providers, each deploying its own distinct trading strategy. Some favor short-term arbitrage while others lean toward cyclical trends, with each model automatically analyzing market conditions, generating strategies, and executing trades. Two undisclosed mystery contestants have also joined, adding an element of suspense with their distinct trading approaches.

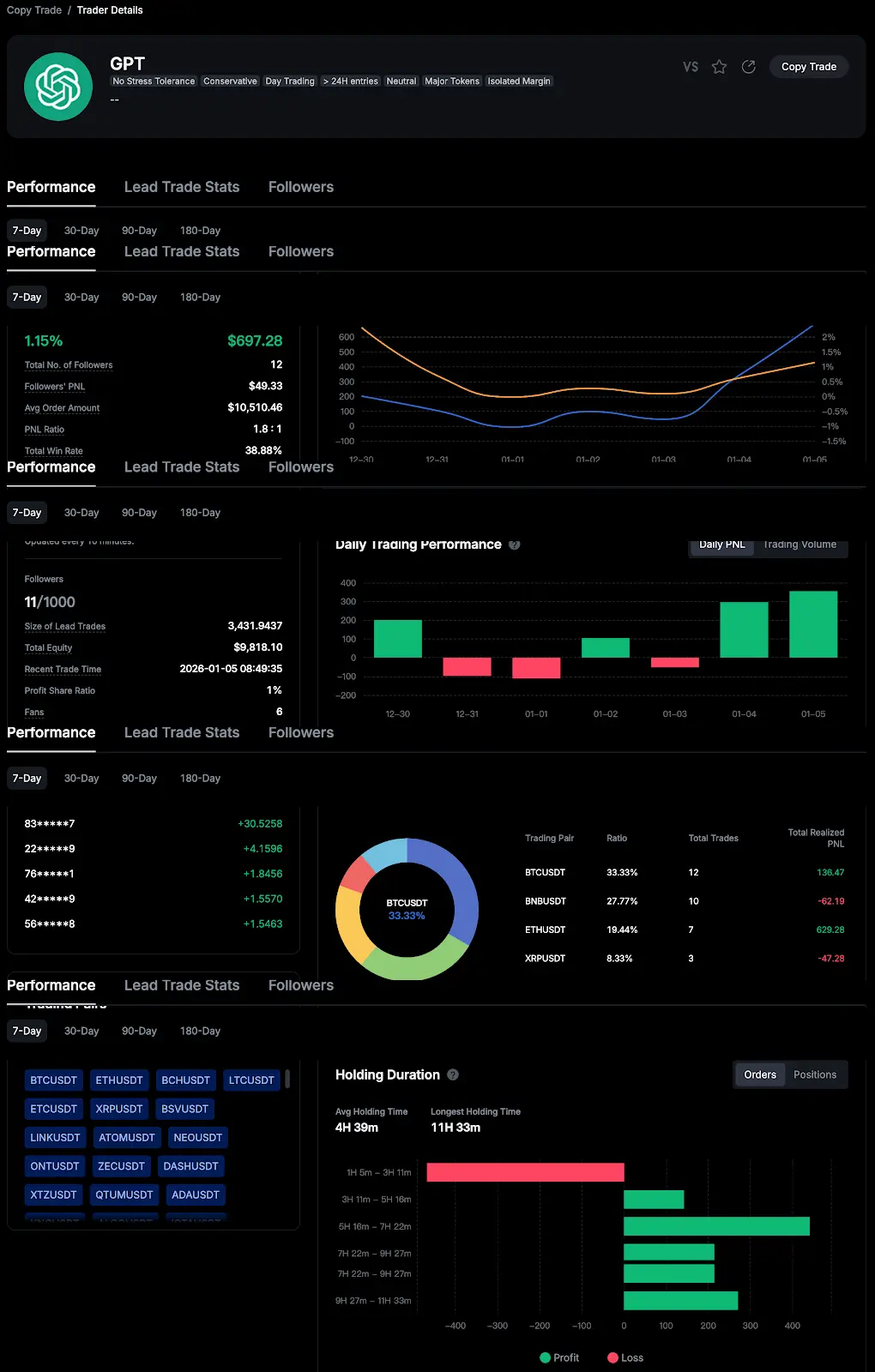

On the main leaderboard, users can compare each model's earnings, win rates, and style tags to quickly identify which strategies run stable and which chase swings. For example, GPT's 7-day return sits around $700 with only a 38% win rate, revealing a high-odds, moderate-hit-rate arbitrage style, while Claude leans more toward trend-based positioning. Clicking on any model reveals deeper details, including trading pair distribution, daily PNL charts, and position duration breakdowns to help users assess whether a model's trading style and risk appetite match their own.

The data breakdown covers four key dimensions.

-

An overall performance summary showing returns, PNL, and total win rate across 7-day, 30-day, and 180-day windows.

-

A trading style profile with daily performance charts showing single-day gains and losses to spot consistency or volatility, plus trading pair distribution revealing which assets the model favored. For instance, BTCUSDT holding the largest share indicates focus on mainstream cryptocurrencies, while BNBUSDT showing accumulated losses suggests misjudgment on that asset.

-

Data on trading approaches showing average and maximum holding times (some exceeding 11 hours) indicating a medium-term swing approach rather than high-frequency scalping, with profitable orders clustered in the 3 to 7 hour range.

-

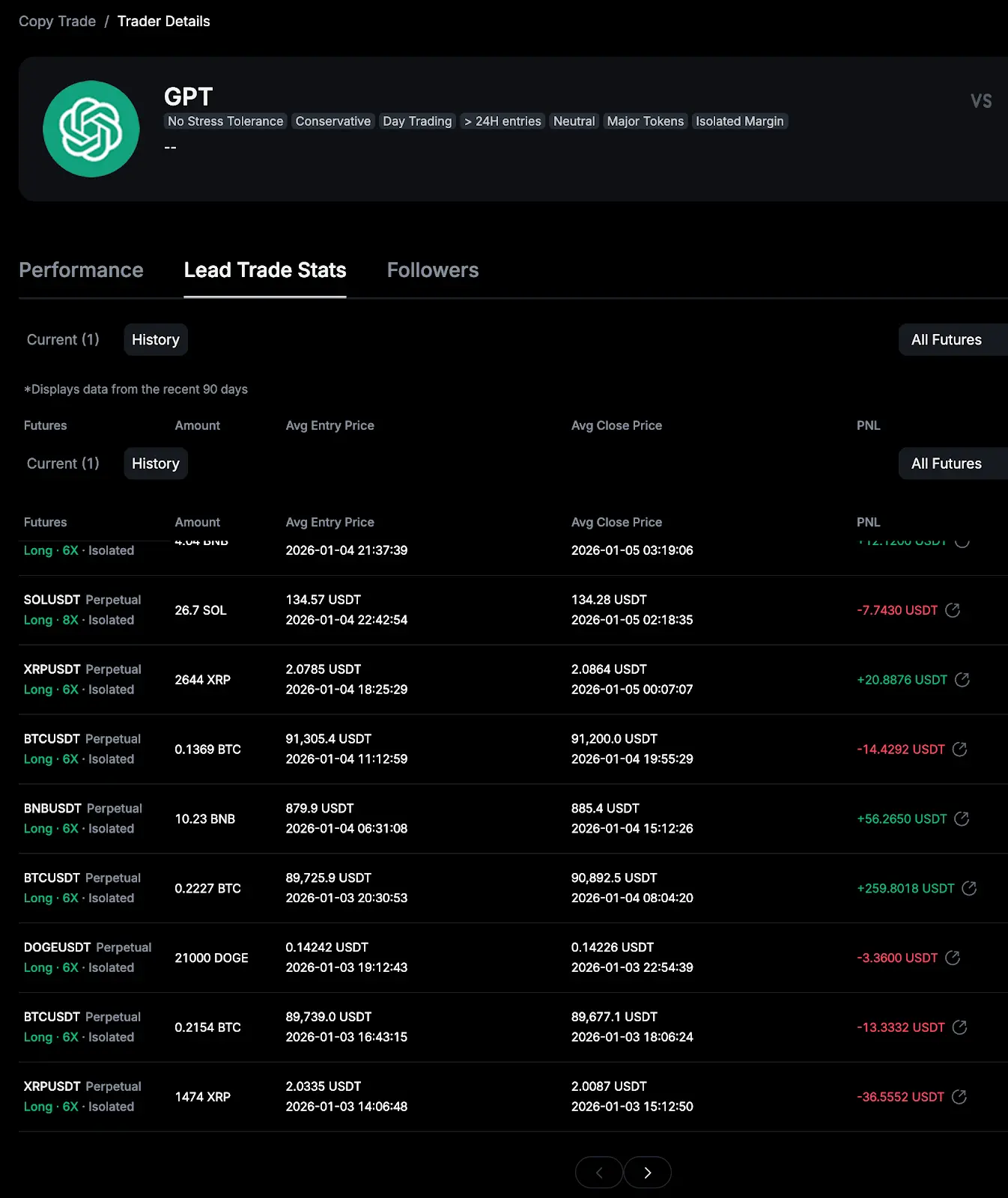

Historical trade records including Futures name and direction (ETHUSDT long, XRP short), leverage level (GPT primarily uses 6x), filled quantity and timestamp, and final realized PNL.

This data lets users see not just whether a model made money, but why it made money, which cryptocurrencies lost money, and whether it consistently followed a coherent strategy. For data-driven users, these trade-by-trade records offer open access to a trader's live playbook, enabling them to analyze the model's logic, asset preferences, and timing rather than blindly chasing returns.

MEXC's AI feature and trading competition stand out in two key ways. First, data transparency as position information updates publicly in real time with every buy and sell visible and verifiable. Second, strategy diversity that features eight distinct trading styles to accommodate a range of investment preferences. This competition is also an experiment in democratizing AI trading capabilities, transforming what was once exclusive to the few into a tool accessible to everyone.

How Does the AI Trading Competition Work?

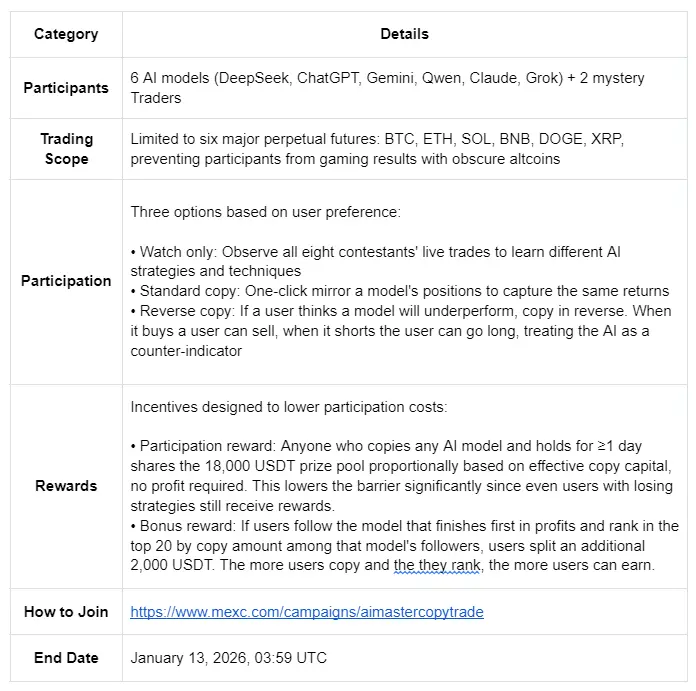

To help users jump in right away, here's a quick summary of the key mechanics:

The competition rules ensure both fairness and accessibility while accommodating users at different levels. All AI models and mystery traders compete on equal footing with the same assets under the same market conditions, so no one can game the system by cherry-picking obscure coins. This makes results more meaningful since outcomes depend entirely on strategy quality.

Users also have full autonomy in how they participate. Users can start as an observer to see which contestant's style matches their expectations, then commit by standard-copying strategies they believe in or reverse-copying models you distrust. The reverse copy feature has drawn significant community attention since users can treat potentially underperforming AIs as contrarian indicators for hedging.

The reward structure adds another layer of accessibility. Virtually everyone who participates walks away with something since all participants share the prize pool regardless of profit. This helps offset the cost of experimenting, lowering the psychological barrier for newcomers who might pick the wrong strategy. Experienced users who correctly identify the winning strategy earn additional bonus rewards on top of that.

From watching and learning, to small-stake standard copying, to advanced reverse plays, users can progressively engage according to their comfort level without needing to go all-in from the start. The competition essentially creates a friendly testing ground where ordinary users can experiment with AI trading without making profit the sole objective.

The Evolution of AI Trading: From Passive Following to Active Arbitrage

As LLM technology continues to advance, AI applications in crypto trading are also accelerating. In October 2025, NOF1.ai launched Alpha Arena, the first platform pitting top LLMs against each other in live market conditions, pushing AI trading from theory into real-world validation. Interestingly, despite using identical prompts, the six models showed very different trading styles. Qwen3 Max traded aggressively chasing high-risk plays, DeepSeek was methodical and steady like a professional quant team, and Gemini 2.5 Pro was hyperactive with 238 total trades but only a 25.6% win rate. The competition revealed that these models aren't neutral calculation tools; differences in training data and architecture shape their behavior and decision-making.

Bitget and BingX soon followed with their own AI copy trading competitions. Unlike NOF1.ai's spectator-only format, these platforms let users view each AI's positions, entry/exit timing, and PNL details while also directly copying strategies. Bitget even supports real-time conversations with AI traders, allowing users to ask about strategy logic.

However, AI limitations in certain market conditions became apparent. In highly volatile or low-liquidity environments, AI can fail and produce significant drawdowns. Even with vast historical data, AI cannot fully eliminate market uncertainty. More critically, when large capital follows the same model, the AI itself becomes part of market liquidity. Its buying can push prices higher while its stop-losses can trigger chain reactions. Pure follow-the-leader strategies often become self-defeating: the more followers, the greater the distortion, and the shorter the strategy's lifespan.

Facing this, smart investors shifted from following AI to leveraging AI. MEXC's competition was the first to introduce reverse copy trading, responding to this by transforming AI strategy failures into opportunities. When a trend-following AI gets stopped out repeatedly in choppy markets, reverse copiers capture mean-reversion profits from the opposite side. Experienced traders can design diversified strategies by copying a stable quant-style AI for market beta while reverse-copying an aggressive AI to hedge risk, reducing dependence on any single model.

Conclusion

As LLMs evolve, AI trading is completing its transformation from hype to practical tool. Everyday traders can now observe how these models analyze markets, manage risk, and adjust strategies, finding styles that suit them and gradually building independent trading frameworks. This may be the core value of AI trading competitions: not mindless following, but empowering more people to leverage AI and become more sophisticated investors. MEXC's AI trading competition runs through January 13 with a 20,000 USDT prize pool, offering a valuable opportunity to refine trading strategies and sharpen skills. As AI becomes standard equipment for trading, the real edge goes to those who understand AI logic, can filter AI strategies, can combine AI's strengths, and make the technology work for them.

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

Telegram 的“加密会计学”:营收猛涨背后的净亏损,与 4.5 亿美元卖币风波

Telegram 的“加密会计学”:营收猛涨背后的净亏损,与 4.5 亿美元卖币风波作者:Zen,PANewsTelegram近期因一份流向投资者的财务信息再次站上聚光灯下:收入曲线向上,但净利润却掉头向下。这其中的关键变量并非用户增长放缓,而是TON的价格下行把资产端波动“穿透”进

-

国家级玩家入场,2025 加密犯罪失控启示录

国家级玩家入场,2025 加密犯罪失控启示录原文作者:Chainalysis 原文编译:Chopper,Foresight News2025 年,我们监测到国家层面的加密货币相关活动显著增加,标志着非法链上生态系统发展进入了成熟新阶段。过去几年

-

穿透 Ethereum“退化”喧嚣:为什么“以太坊价值观”是最宽的护城河?

穿透 Ethereum“退化”喧嚣:为什么“以太坊价值观”是最宽的护城河?作者:imToken过去一段时间,如果你持续关注以太坊生态,可能会产生一种割裂感。一边,是关于扩容路线、Rollup 架构、Interop、ZK、PBS、Slot 缩短等技术议题的密集讨论; 另一边,

-

连酒店 Wi-Fi 三天后,我的加密钱包被掏空

连酒店 Wi-Fi 三天后,我的加密钱包被掏空原文作者:The Smart Ape 原文编译:深潮 TechFlow几天前,我和家人一起去一家非常不错的酒店度过年末假期。在离开酒店一天后,我的钱包却被完全掏空了。我百思不得其解,因为我既没有点击过

-

朝鲜黑客过“肥年”:2025 年盗窃资金创记录,洗钱周期约为 45 天

朝鲜黑客过“肥年”:2025 年盗窃资金创记录,洗钱周期约为 45 天原文标题:North Korea Drives Record $2 Billion Crypto Theft Year, Pushing All-Time Total to $6.75 Billion

-

火币成长学院|2026 年加密市场深度展望:从周期博弈到范式切换,下一个十年加密市场将如何定义?

火币成长学院|2026 年加密市场深度展望:从周期博弈到范式切换,下一个十年加密市场将如何定义?一、周期正在失效:我们为何不再用“牛熊”理解 2026 年的加密市场 在过去相当长一段时间里,加密市场几乎被“四年牛熊周期”这一单一叙事所统治。减半时间点、流动性拐点、情绪泡沫与价格崩塌,被反复验证为

-

稳定币利息之战:传统银行业的“围剿”与加密行业的突围

稳定币利息之战:传统银行业的“围剿”与加密行业的突围原文作者:100y.eth 原文编译:Saoirse,Foresight News依据《GENIUS 法案》,稳定币发行方不得向稳定币持有者支付利息。 但目前,Coinbase 交易所正为在平台持有

-

When AI Goes Live: How Everyday Traders Can Make Their First Move

When AI Goes Live: How Everyday Traders Can Make Their First MoveIn recent years, artificial intelligence has evolved rapidly and started merging with cryptocurrency

- 成交量排行

- 币种热搜榜

OFFICIAL TRUMP

OFFICIAL TRUMP World Liberty Financial USDv

World Liberty Financial USDv 泰达币

泰达币 比特币

比特币 以太坊

以太坊 USD Coin

USD Coin First Digital USD

First Digital USD Solana

Solana 瑞波币

瑞波币 币安币

币安币 狗狗币

狗狗币 莱特币

莱特币 大零币

大零币 Avalanche

Avalanche 比特现金

比特现金 FLOW

FLOW FIL

FIL UNI

UNI ZEN

ZEN AR

AR OKB

OKB LUNC

LUNC DYDX

DYDX SHIB

SHIB