How to Build Your Own SCP App: Domain-oriented PoS Design — Token DAO

In the last blog post, we introduced a domain-oriented PoS design. We foresee that in the rising era of WEB3, developers will not be limited to traditional Layer1 blockchain and EVM. Still, there will be more paradigms to build WEB3 applications. SCP is a smart choice for WEB3 development architecture design, allowing developers to focus on domain-oriented PoS design. This article will provide an in-depth example of domain-oriented PoS and explain how to solve the trust problem through domain-oriented PoS, and create a trustless DAO for collaboration between users through PoS.

Token security is an oft-criticized topic in blockchain security. On blockchains, anyone can issue tokens, and the quality of these tokens varies. There are even hackers who maliciously issue tokens that can only be bought but not sold to scam users. In the blockchain industry, smart contracts are the law. Still, the terms of these contracts can only be identified by professional technical experts. It is difficult for users to distinguish between valid and secure tokens and malicious tokens in hundreds of lines of code.

imToken has created a token profile (https://github.com/consenlabs/token-profile), where token projects submit token information themselves on GitHub. Those submissions will be reviewed by an authority (imToken) before being displayed in the imToken wallet. If there is a malicious token, it is usually fed back to the authority by the user and re-audited by the authority, which is a long and troublesome process. everFinance has encountered malicious tokens EVER. The lengthy auditing process, which requires interfacing with various agencies and media, has dramatically delayed the flagging and publicizing of the malicious token. So, do we have a decentralized and more efficient token identification mechanism? And make the process of labeling tokens transparent and trustworthy, accurate and fast through financial incentives?

Common Auditing Process

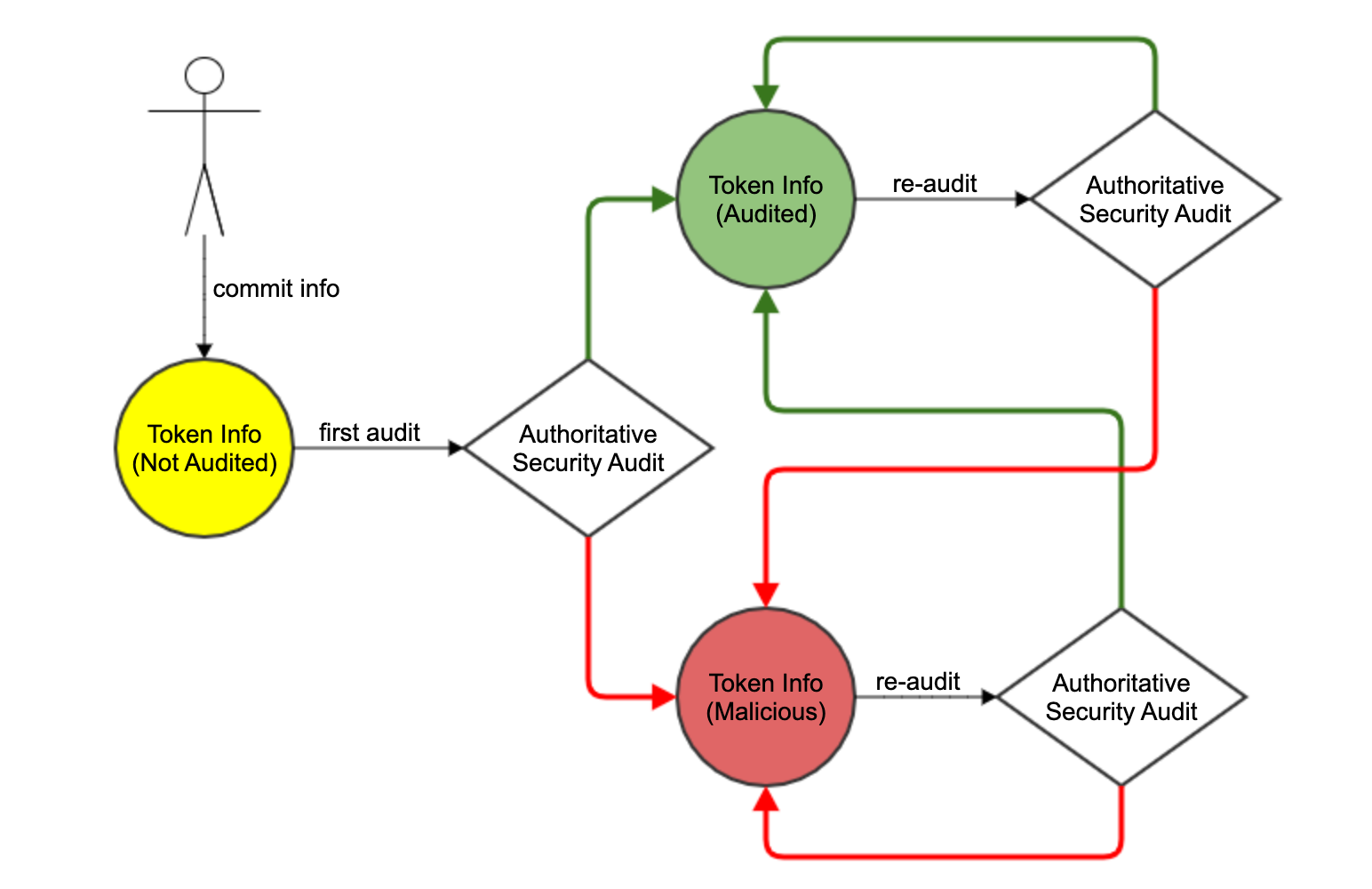

The typical approach of token security relies on a centralized authority for auditing. The risk control mechanism for tokens is summarized in the flow shown below:

In the above figure, the token issuer or user submits token information. The status of the token audition is yellow. The authority will audit the token information and mark the tokens as green for secure tokens and red for risky tokens. If the authority audits the token incorrectly, auditing is started over, and the token status is re-labeled after re-auditing.

In the traditional security world, this process is repeated by an authority every time a new token is created. The user of the token information needs to trust the authority and wait for the authority’s re-audit when the token information is faulty.

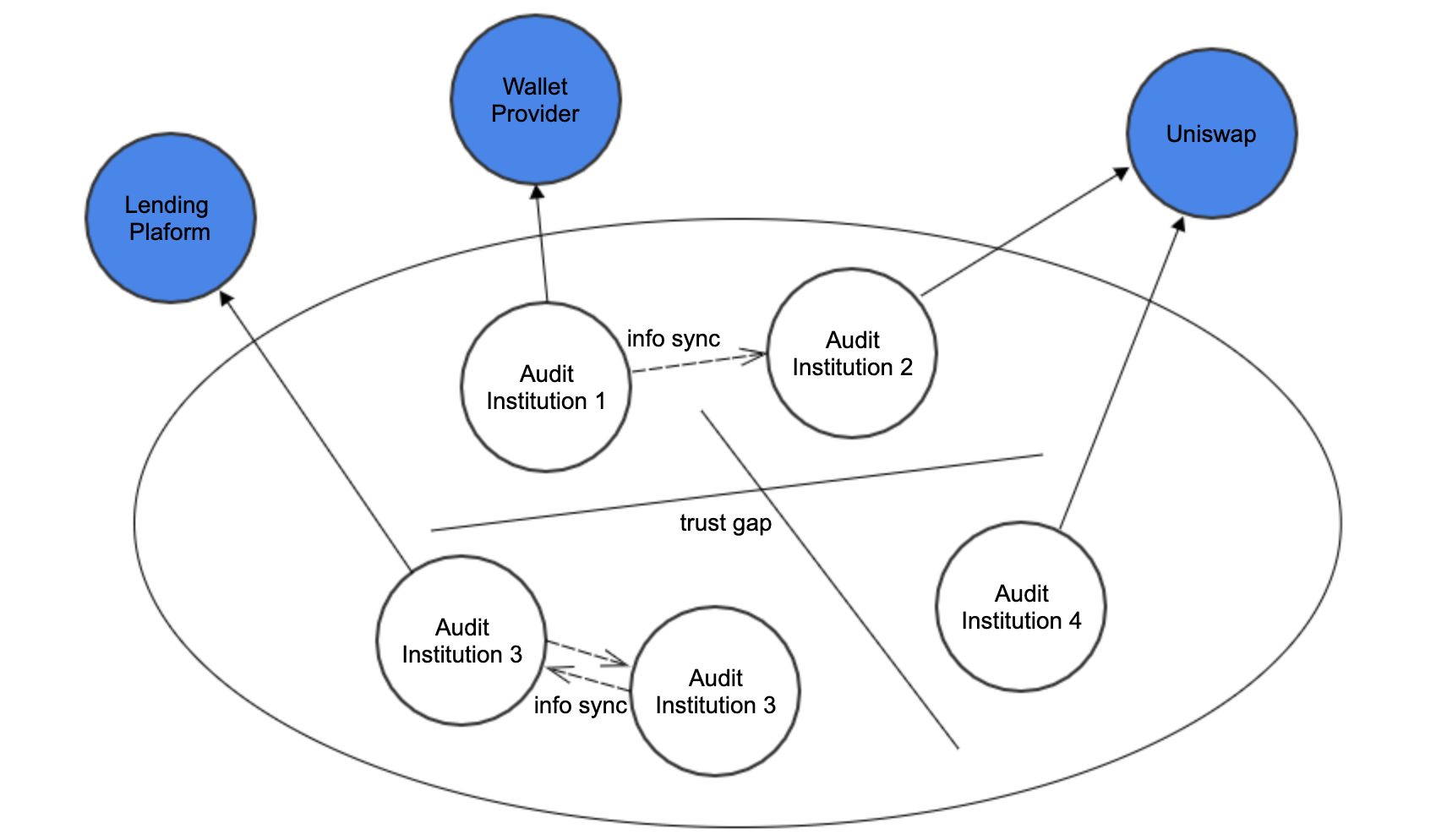

At the same time, the security of the token is repeatedly audited by different authorities, and absolute trust is not always reached for other authorities. We can see that security-related information is produced in a disparate and untrustworthy information network and managed independently by different authorities.

There are two crucial problems with the existing mechanism:

- The applications completely trust and rely on the authorities. There is a massive single point of risk for the token information.

- Security information is scattered among different authorities. There is a huge trust gap between authorities, with a time-consuming information-sharing process.

Authorities and Trust Gap

Trusting authorities generates a huge single point of risk. It is why many apps build their own security risk control systems. Single point of risk may lead to untimely token information updates or even wrong token information. When the business pays much attention to security, the application provider needs to conduct a repeated review of the content in addition to the authority, which reduces the efficiency but also increases the cost of sharing security information.

Due to trust issues, the security of the token is not quickly agreed upon among organizations. When a risky token is labeled, repeated audits and lengthy verification processes are often required between authorities before the final token security information can be updated.

Altcoin, Big Risk

For some small-cap altcoins, due to the high audit cost, it will lead to the fact that no authority verifies them. The authority will be alerted only when the altcoins lead to significant financial problems. Such security information lag commonly happens.

Using DAO to Govern Security

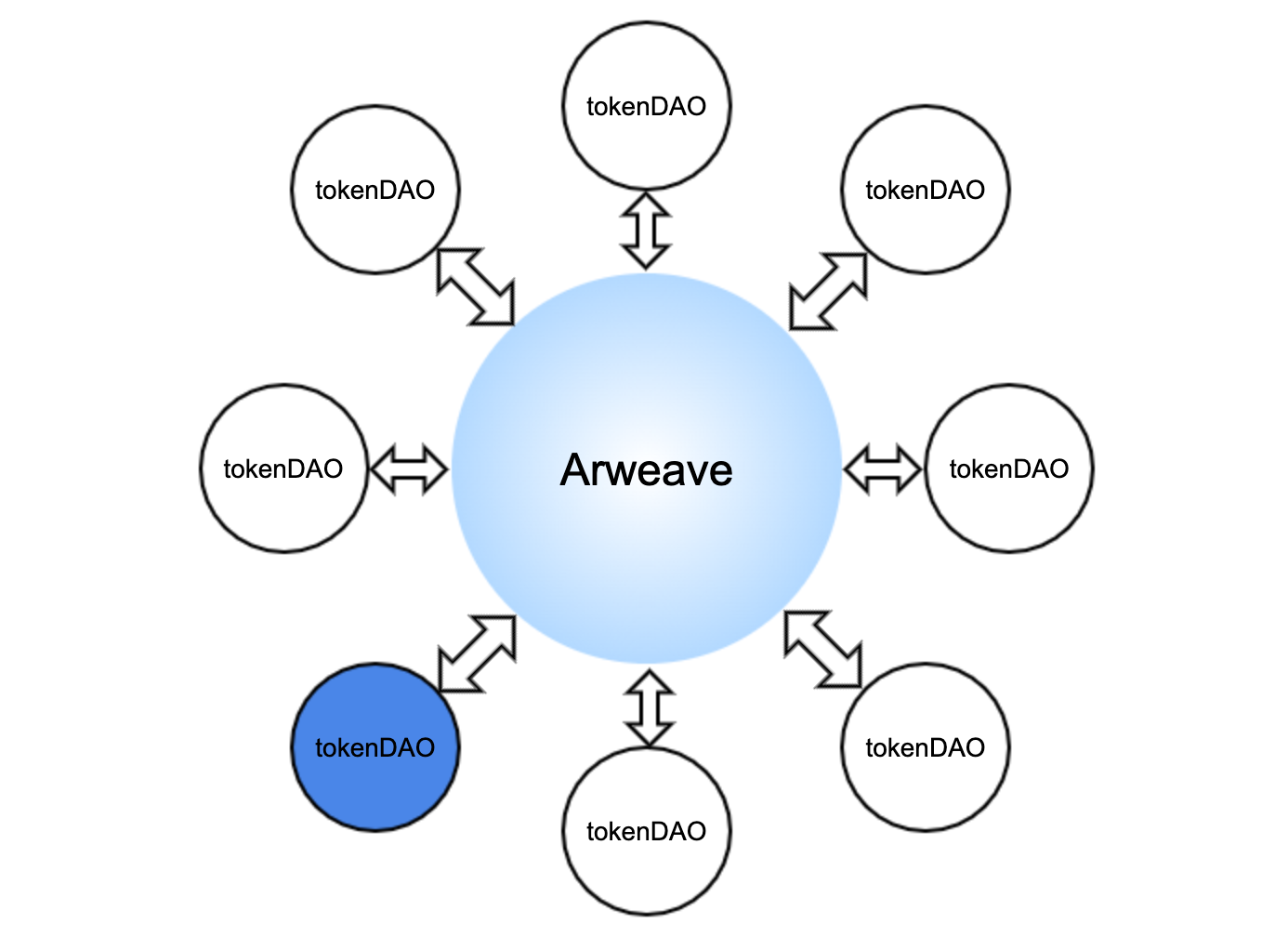

The Storage-based Consensus Paradigm (SCP) advocated by Arweave and everFinance opens up new possibilities in the field of token security:

- No more trust gaps, token information is trustworthy, and the consensus of the DAO is the only trusted source

- No more reliance on authorities, decentralizing token information so that anyone can get accurate information

- No access control, any institution or individual can participate in DAO without permission

- Faster token information validation, with DAO’s economic incentive model incentivizing members to process new token information quickly

How to Build

Reasonable financial incentives are a vital element in creating a DAO. The traditional security auditing process cannot solve the consensus on security information or the single centralized point of risk.

We can develop a tokenDAO node, an off-chain smart contract for DAO members’ collaboration. The node’s code defines the template for uploading token information, the token mechanism, how to conduct voting, rewards and penalties, and other related rules.

There will be a token called TOK in tokenDAO. TOK is a profit-sharing community token, and anyone can go to everPay Swap to get TOK. TOK functions include:

- Incentivize correct token information uploads

- Incentivize correct token labeling

- Vote on token information

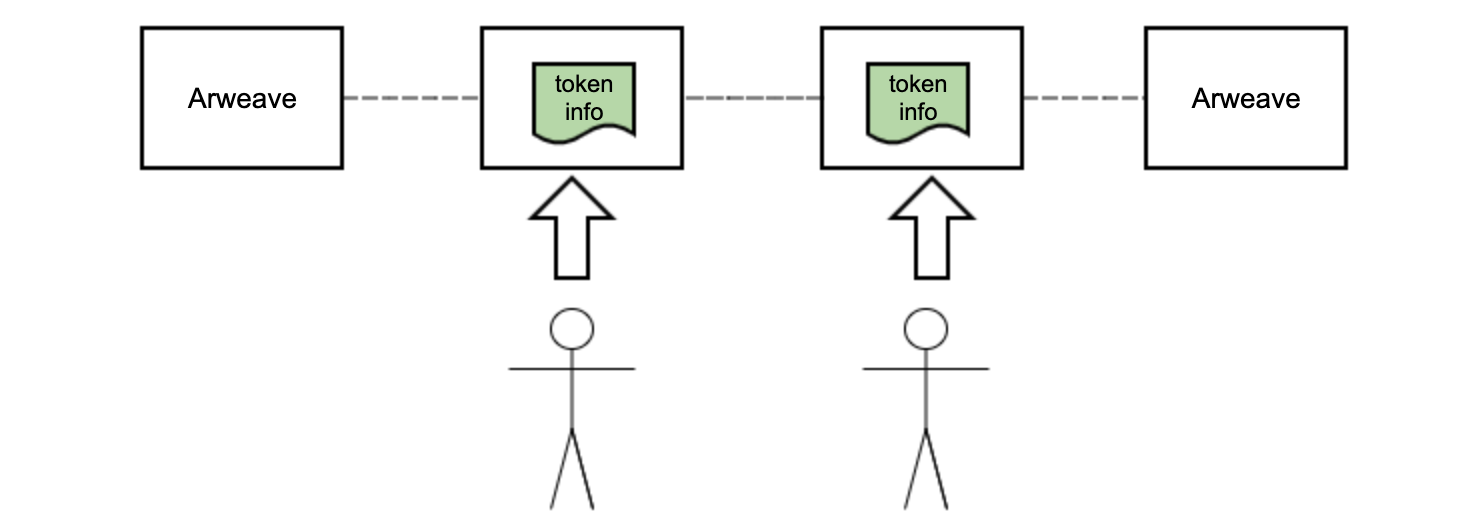

Token Upload

Token information will be uploaded to Arweave and must be uploaded according to the data template specified by tokenDAO. Incorrect data fields or duplicated uploads are considered invalid. Once valid data is uploaded to Arweave, it is loaded into the tokenDAO node. tokenDAO nodes automatically store the uploader address of each piece of data. TOK can be staked to each token information. The more TOKs are staked for each token information, the more TOK rewards the uploader receives. However, the TOK reward for the uploader is much lower than the reward for staking tokens for labeling since collecting information is much easier than labeling information.

Token Labelling

Any user holding a TOK can stake their TOK to valid token information. TOK staking is a ternary operation consisting of: no staking, stake the token as safe, and stake the token as scammy. When there is no staking, there are no rewards to the units of TOK. Staking a token as safe or scam can result in a reward or a penalty. The holder of a TOK needs to correctly determine if the token is malicious. The penalty for a wrong stake is greater than the reward of a correct stake to keep the quality of each stake and avoid arbitrary stakes.

A TOK can be staked to any number of token information. Different stakes can be chosen for different token information: stake for safe or for dangerous. A unit value of TOK is less profitable if it is staked to only one token, and most profitable if it is staked to all tokens in the network. A TOK can also be delegated to a third party to stake.

Information Correction

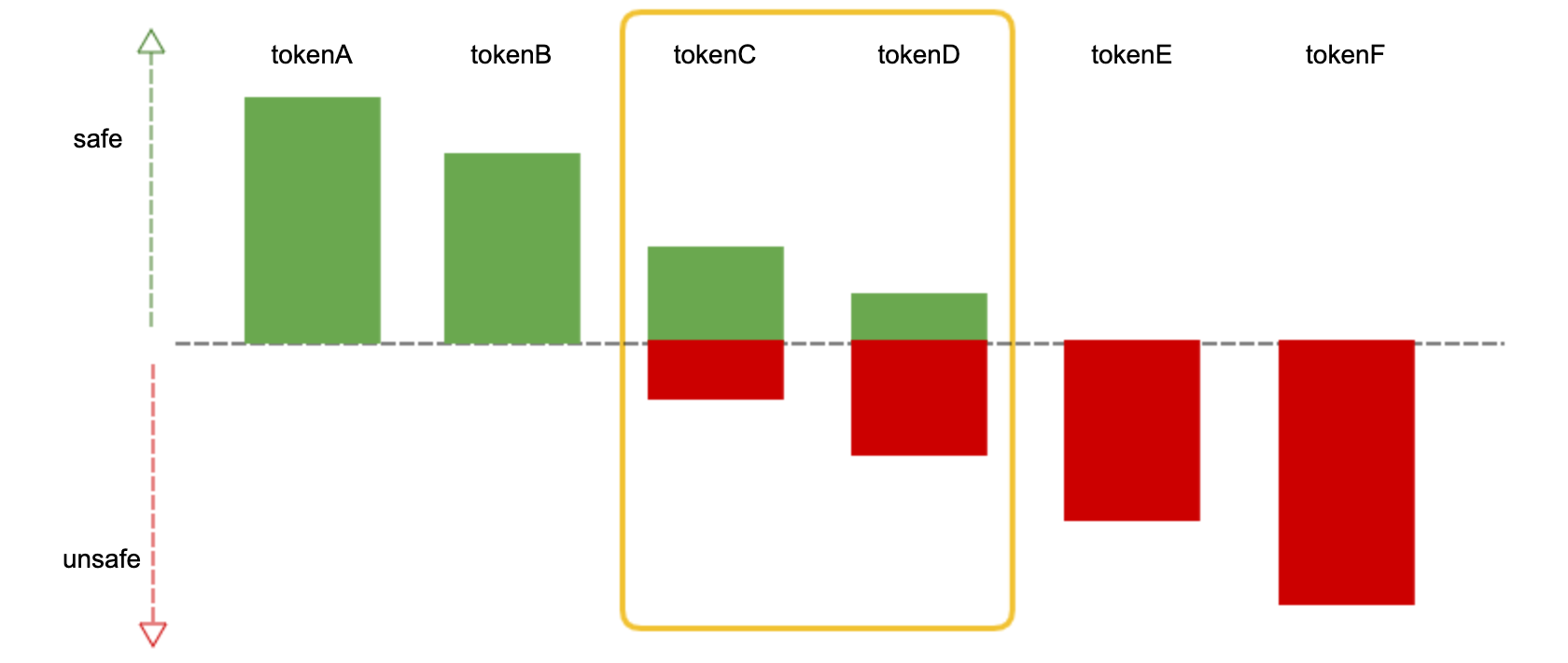

The graph shows the results generated by TOK stakes. The green bar represents the number of safe stakes, and the red bar represents the number of dangerous stakes. tokenA has a large amount of TOK staked as safe, while tokenC has a large amount of TOK staked as safe and a small amount staked as unsafe, which is a controversial token. If anyone staked for danger for tokenA, tokenA becomes a controversial token, and the token enters the uncertainty state.

Within n hours of the token being controversial, the user can choose to change the stake type, and if a new consensus is reached within n hours, the token is automatically released from dispute. If there is still a controversy after n hours, a voting phase will take place. Any user with a TOK can vote on the controversial token. Ultimately, the wrong side of the stake is forfeited and awarded to the voter and the staker with the correct choice.

How to Use tokenDAO

The DAO is entirely free, and anyone can download the tokenDAO node. Running the node will automatically sync token information from Arweave and generate staking and voting conditions for each token according to the transaction history on Arweave. Once the tokenDAO node is synced to the latest block on Arweave, users can access the tokenDAO API to get the latest, fully decentralized, secure token information consensus.

Conclusion

Arweave + SCP allows us to quickly create a domain-oriented PoS and DAO based on a domain-specific problem. The model can be adapted to a broader range of domains. Whether blockchainless DEX or decentralized new media mentioned in previous blogs, similar projects can all be economically incentivized by domain-oriented PoS design tokens. Arweave + SCP solves the consensus problem and provides developers with the freedom to develop architecture designs. Arweave + SCP will pave the technical path for WEB3.

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

LuBian 矿池遭黑客攻击被窃取巨额比特币事件技术溯源分析报告

LuBian 矿池遭黑客攻击被窃取巨额比特币事件技术溯源分析报告作者:国家计算机病毒应急处理中心2020年12月29日,LuBian矿池发生一起重大黑客攻击事件,总计127272.06953176枚比特币(当时市值约35亿美元,现市值已达150亿美元)被攻击者窃取

-

为什么加密市场情绪突然变得如此悲观?

为什么加密市场情绪突然变得如此悲观?原文标题:Why Did Crypto Sentiment Get So Bearish? 原文作者:Jack Inabinet,Bankless 原文编译:Peggy,BlockBeats编者按:在

-

宏观解读:鲍威尔的“浓雾驾驶”与金融“饥饿游戏”

宏观解读:鲍威尔的“浓雾驾驶”与金融“饥饿游戏”原文标题:"Driving in Fog” and the Financial Hunger Games 原文作者:@arndxt_xo 原文编译:叮当,Odaily 星球日报大幅回调与量化宽松(QE

-

DeFi 的自然选择:适者生存

DeFi 的自然选择:适者生存作者:cryptographic 编译:Block unicorn前言 自然是冷酷无情的,它没有情感,没有感觉,没有依恋,它只进行着一场永无止境的考验:这种设计是否值得生存。 金融市场亦是如此,随着时

-

MEET48:从造星梦工厂走向链上奈飞 —— AIUGC 与 Web3 重塑文娱经济

Web3文娱正从泡沫退潮迎来重启时刻,以MEET48为代表的项目正通过AI Web3 UGC技术融合重塑内容生产与价值分配范式,构建可持续代币经济体系,从应用走向基础设施,致力成为"链上奈飞"并推动W

-

BitMEX Alpha:这次也一样,加密周期不会失效

BitMEX Alpha:这次也一样,加密周期不会失效“每当我们听到‘这次不一样’时,周期最终都证明‘并无不同’。” 每隔四年,比特币市场都会遵循一个极其一致的节奏,而塑造这个节奏的是一个比特币的原生代码:挖矿奖励减半。大约每 210,000 个区块,网

-

利润压缩下的矿企求生:Marathon 卖币求生,行业抛售潮暗涌

利润压缩下的矿企求生:Marathon 卖币求生,行业抛售潮暗涌原文作者:Gino Matos 原文编译:Luffy,Foresight NewsMarathon 的第三季度财报中,暗藏着一项明确的政策转变。公司宣布,今后将出售部分新挖出的比特币,以支撑运营资金需

-

Geth 源码系列:交易设计及实现

Geth 源码系列:交易设计及实现1. 交易简介 以太坊执行层可以看作是一个交易驱动的状态机,交易是唯一修改状态的方式。交易只能由 EOA 发起,并且会在交易中附加私钥的签名,交易执行之后就会更新以太坊网络的状态。以太坊网络中最简单的

- 成交量排行

- 币种热搜榜

OFFICIAL TRUMP

OFFICIAL TRUMP Pepe

Pepe 泰达币

泰达币 比特币

比特币 以太坊

以太坊 USD Coin

USD Coin Solana

Solana 大零币

大零币 瑞波币

瑞波币 First Digital USD

First Digital USD 币安币

币安币 Filecoin

Filecoin 狗狗币

狗狗币 Internet Computer(Dfinity)

Internet Computer(Dfinity) 达世币

达世币 ZEN

ZEN AR

AR OKB

OKB BSV

BSV ETC

ETC EOS

EOS MINA

MINA CFX

CFX