【Bitmidas】Bitcoin Trend Analytics 25th March 2022

BTC/USD, using Investing data flow for the analysis

Time of Analysis 08:55 UTC+8

Time of Translation & Publication 11:00 UTC+8

Recap:

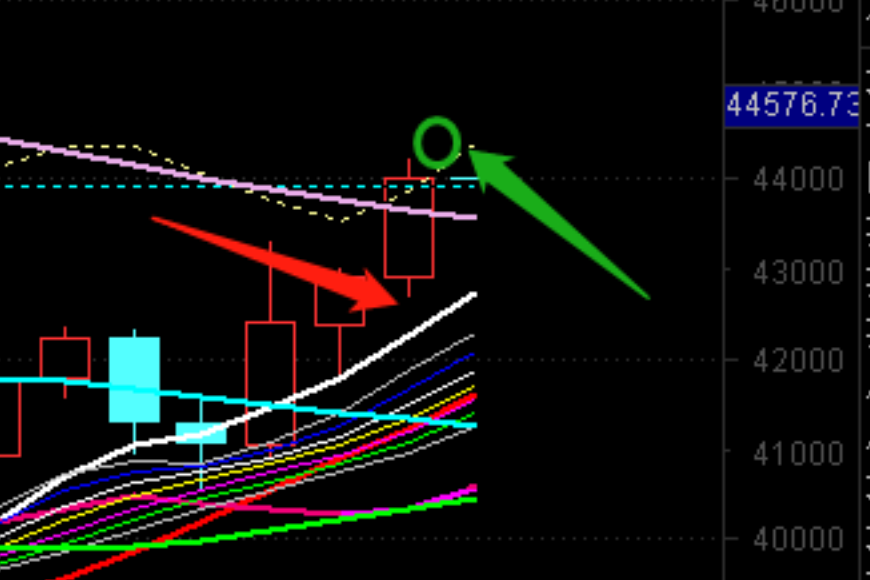

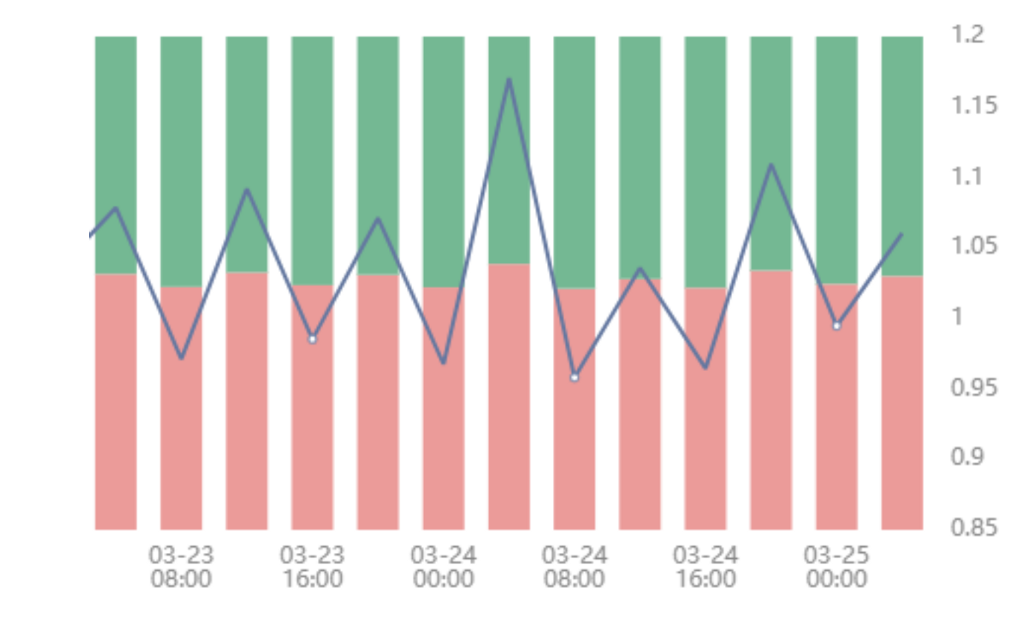

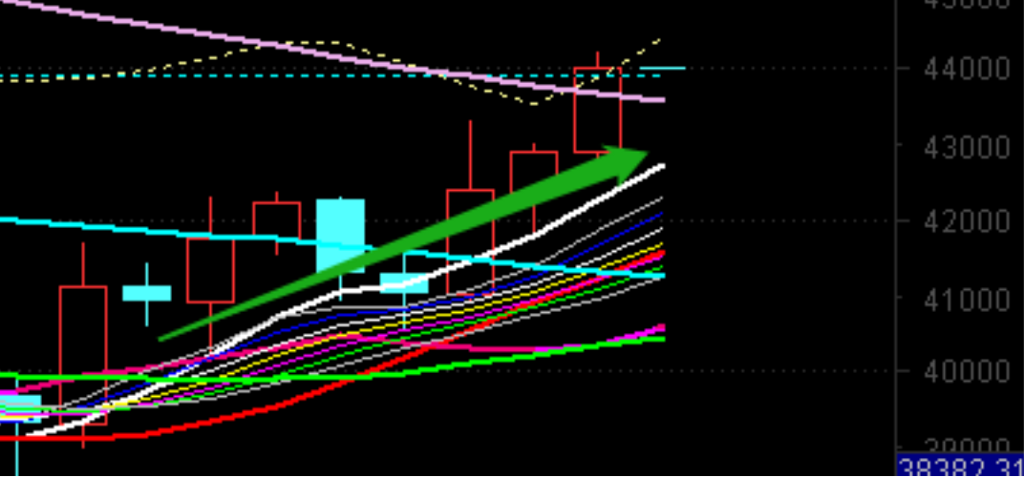

Yesterday we saw an increase of long positions in stats, forcing shorts backward. As it stood firm above 41948.69, BTC was in a condition to break up 43912.8. When 43912.8 is broken, the first resistance is at 44762.99.

As we can see from the chart, BTC stood at 42500 above 41948.69 and then rallied towards 43912.8, yet suppressed by the resistant band at 44762.99.

The opening price today is 44013 at 08:00 UTC+8

Trend Analysis:

Now BTC breaks out the congestion yet solid above 43912.8. 44850.31 has been a strong resistance. Within a short period after 8:00 (UTC+9), the price would oscillate around 43912.8 and try to stand firm before rallying to 44850.31. It’s quite common to see the price rise above or come underneath 43912.8.

As it breaks the upper resistance of the congestion, BTC maintains a bullish momentum in a short term. The bullish support came to 42551.71~42718.13 from 41948.69, with its core at 42551.71, diversion at 42718.13.

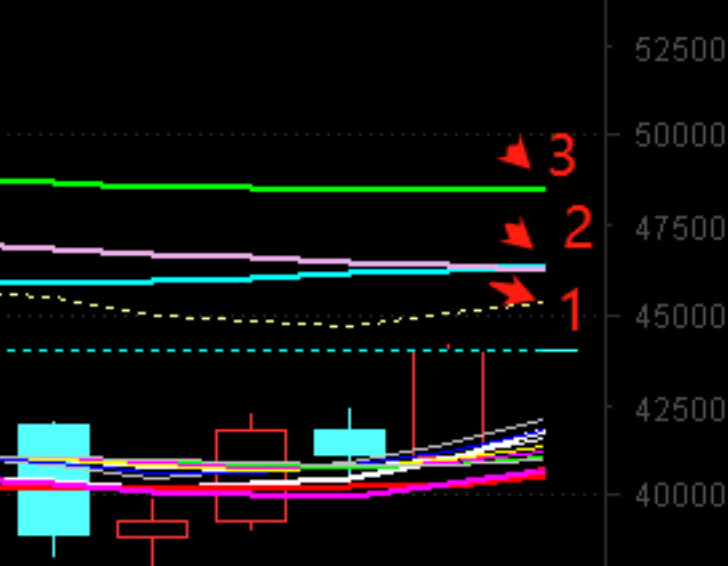

Next, we have multiple resistance above: 45423.84, 46359.31, and 47703.59.

Today, BTC will first move between 42551.71~45423.84, centering 43912.8 for some time. Previous resistance at 44850.31 will be weakened during this process and lose its strength in the analysis today.

There is only 1 level range to focus on today:

1. The short-term support at 42551.71. In fact, there is a support zone between 42551.71~42718.13. As long as the core support keeps diverting upward, the bullish momentum continues. As indicated by the green arrow in the chart, the core support resulting from our algorithm has been diverting upward for some time till now.

Currently, BTC is in correction among a long-term bullish trend. Only by breaking the calculated resistance (indicated by the red arrow) could BTC see a full recovery of the bullish trend. Before that, the price would move upward incrementally between key supports and resistances.

Supports:

43453.32; 43096.79; 42718.13~42551.71; 42008.58; 41394.66; 40821.84; 40550.31; 39725.66; 38950.05; 37371.02~37047.73; 36946.25 (pointless to see further down atm)

Resistances:

44850.31; 45423.84; 45843.53; 46359.31; 47703.59; 48181.91; 48719.63; 49742.48; 50843.93; 51606.97; 53821.93 (pointless to see further above atm)

Follow us on https://twitter.com/BitMidas to get instant daily updates!

*Not Financial Advice.

1.资讯内容不构成投资建议,投资者应独立决策并自行承担风险

2.本文版权归属原作所有,仅代表作者本人观点,不代表本站的观点或立场

您可能感兴趣

-

比特币暴跌背后:ETF 退潮、机构撤资与聪明钱抛售

比特币暴跌背后:ETF 退潮、机构撤资与聪明钱抛售CoinW 研究院1.比特币暴跌与市场共振 11 月 4 日,加密市场遭遇剧烈冲击,整体陷入低迷。比特币价格一度跌破 10 万美元关口,最低下探 9.9 万美元,这是自年内高点以来最显著的一次回调。与

-

活到低风险 DeFi 到来,散户熊市生存策略

War. War Never Change.作者:佐爷10·11 和 11·3 事件的直接诱因都不是收益型稳定币,但以戏剧性的方式接连重击 USDe 和 xUSD,Aave 硬编码 USDe 锚定 U

-

Perp DEX 行业深度研报: 从技术突破到生态竞争的全面升级

Perp DEX赛道已成功跨越技术验证期,进入生态与模式竞争的新阶段。作者:Yiran(Bitfox Research)摘要永续合约DEX赛道在2025年迎来爆发式增长,市场份额从年初的5%飙升至20

-

彭博社:13 亿美元账面亏损,Tom Lee 的以太坊豪赌面临崩溃?

彭博社:13 亿美元账面亏损,Tom Lee 的以太坊豪赌面临崩溃?原文标题:Tom Lee's Big Crypto Bet Buckles Under Mounting Market Strain原文作者:Sidhartha Shukla,Bloomberg原文编

-

Arthur Hayes 拆解债务、回购与印钞:美元流动性的终极循环

Arthur Hayes 拆解债务、回购与印钞:美元流动性的终极循环原文标题:Hallelujah原文作者:Arthur Hayes,BitMEX 联创原文编译:比推 BitpushNews引言:政治激励与债务的必然性 赞颂中本聪,时间与复利法则的存在,独立于个体身份

-

亏损 80% 后,一个加密交易员的至暗时刻

或许你失去了你的“金币”,但你依然拥有你的“经验值”(XP)。作者:Alexander Choi编译:深潮TechFlow“我为此牺牲了一切……就为了这个……?”就在过去的一周里,你的投资组合从历史最

-

在加密世界坚持短期主义,也行不通了吗?

整体来看,那些带有掠夺性和投机性的项目似乎正在逐步走向瓦解。作者:washed编译:深潮TechFlow短期投机的退潮?首先说明一下,这篇文章是从一个热爱投机的人的视角出发的。我是一个狂热的加密货币和

-

跟单 CZ 的人,现在还好吗?

跟单 CZ 的人,现在还好吗?作者:zhou, ChainCatcher散户最怕被割,更怕错过。CZ 站在这两种情绪的交汇点,一句话能让人一夜翻倍,也能让人一夜归零。剧烈波动的走势在 CZ 相关标的中比比皆是,似乎一旦与他产生连接

- 成交量排行

- 币种热搜榜

Momentum

Momentum OFFICIAL TRUMP

OFFICIAL TRUMP Aster

Aster 泰达币

泰达币 以太坊

以太坊 比特币

比特币 Solana

Solana USD Coin

USD Coin 瑞波币

瑞波币 币安币

币安币 First Digital USD

First Digital USD 狗狗币

狗狗币 大零币

大零币 达世币

达世币 Sui

Sui ZEN

ZEN ICP

ICP OKB

OKB FIL

FIL AR

AR LPT

LPT MINA

MINA BSV

BSV EOS

EOS DYDX

DYDX